Buoyant Economies

Submission to the Financial System Inquiry

![]()

1. The philosophy, principles and objectives of a well-functioning financial system

1.1 It is useful to consider an economy without a financial system to assess the attributes of a well-functioning financial system. In an economy without money, people trade using the principles of barter. Barter is a reciprocal arrangement in which people exchange products of similar value. Reciprocity is a fundamental principle of trade regardless of whether it is a barter economy or an economy with money.

1.2 Money facilitates more complex trade than barter, enabling people to sell their products and use the money they earn to buy products of an equivalent value to the product they sold. Essentially, money provides a record of the entitlements of the producer. It is a system intended to preserve the reciprocal nature of trade.

1.3 It is essential for a well-functioning financial system that the monetary system be secure. If economic entities were able to create their own money, they could purchase products without reciprocating. If money were insecure, it would undermine the whole economy, including financial system. To preserve the security of money, counterfeiting money is treated as a serious crime.

1.4 Also, if people were to print their own money, they would have no incentive to produce products to earn it. Without products to buy, money would be worthless. Hence, the security of money is essential to a well-functioning financial system.

2. Funding Growth

2.1 Yet for an economy to grow, it needs more money to facilitate a growth in transactions. This is clearly evident in the basic identity given in quantity theory of money:

MV = PT (1)

Where: M is the quantity of money;

V is the velocity of circulation

P is the average price level; and

T represents transactions.

2.2 “Transactions” in this equation include financial transactions such as debt servicing as well as transactions related to production and income. The velocity of circulation is relatively stable. Therefore, if increased production is to be sold, if prices are to rise, or if debt is to increase and be serviced, then the economy will need more money.

2.3 The process for creating that additional money is of fundamental importance to the health of the economy and the financial system. This first became evident to me in the early 1980’s when I was the economist for the small island economy of Tonga. Tonga established its first bank in 1974. Before that, the Tongan government would convert foreign currency entering the economy into local currency. When that money was spent on imports, the government would convert the local currency back into foreign currency to pay for those imports.

2.4 In 1981, the Tongan government became aware that its foreign reserves (used to fund the conversion of local currency into foreign currency) were being depleted. It found that bank lending was creating additional money in the economy and that this money was financing the purchase of additional imports. Paying for those additional imports required additional foreign currency which depleted foreign reserves. The Tongan Treasury chose to regulate bank lending to ensure that international receipts and payments were balanced. This preserved foreign reserves and ensured the stability of the currency. Also, it allowed foreign income from foreign remittances, exports and tourism to grow and stimulate the economy.

3. Emerging challenges - international current account balance

3.1 At around the same time, Australia was deregulating its banking system. This deregulation allowed the banks to increase lending, which increased imports. The resulting increase in foreign payments in excess of foreign receipts depleted Australia’s foreign reserves. The falling foreign reserves led to instability in the value of the Australian currency. Initially, the value of the currency was devalued. Later, in December 1983, the government chose to float the exchange rate.

3.2 Floating the exchange rate ensured international receipts and payments were equal, and official foreign reserve were preserved. Also, the floating exchange rate system is said to achieve “monetary independence” because international transactions do not affect the domestic money supply. But this means that the system imposes “monetary isolation” because it prevents additional foreign income from exports and tourism from entering and stimulating the economy.

3.3 Rather than treating the cause of the problem (excessive bank lending), Australia has treated the symptom of the problem in a manner that has distorted international trade. This inept response has undermined the Australian economy since that time, in the same way that it has undermined other economies that have applied a similar policy. The effects of the floating exchange rate system are considered in more detail in section 5.

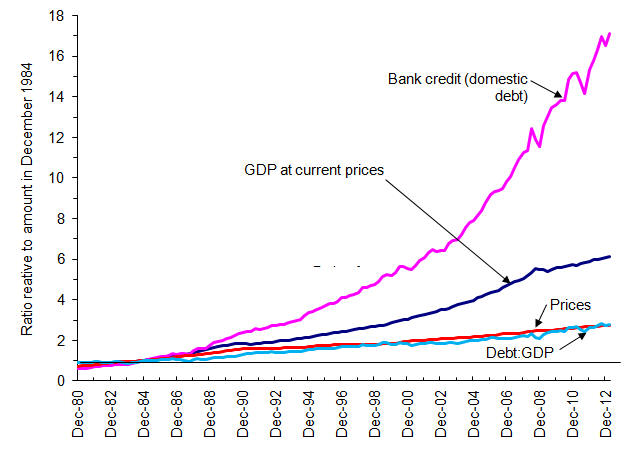

3.4 The Australian Treasury recognised that bank deregulation was a mistake in about 1986. After leaving the Tongan Treasury, I joined the Australian Treasury in mid 1984. Given my experience in Tonga, I investigated whether bank lending was the cause of Australia’s current account deficit. What I found is presented in the following graph[1]. It reveals that the current account deficit is approximately equivalent in value to the growth of bank credit. It implied that the financial system was not fostering reciprocal trade. Instead, the monetary system was being abused, and this was creating new challenges for the Australian economy.

Figure 1. Australia: Bank credit and the current account deficit

3.5 When I presented this graph to my superiors in the Treasury, they initially claimed that it was “a coincidence”. I was not convinced and developed a solution,[2] with the help of Treasury colleagues. Later, the Treasury recognised that the relationship between bank lending and the current account deficit implied that bank deregulation was a mistake. The Treasury had considered bank deregulation as one of its major achievements. Also, the Treasurer had championed bank deregulation. Therefore, the statistics that I had gathered revealing the detrimental effects of bank lending became an embarrassment to the Treasury.

3.6 The reckless changes to the financial system have been allowed to persist for the last 30 years. Without money entering the economy from international trade, the only source of monetary growth was from bank lending, or what many economists prefer to call “investment”. As discussed above, the economy needs additional money to facilitate the increased transactions associated with economic growth. Therefore, the Australian economy became dependant upon more “investment” (bank credit) to attain economic growth.

3.7 While the floating exchange rate system has ensured international receipts and payments are equal, thereby preserving official foreign reserves, it cannot balance current income and expenditure. The current account deficit generated by the growth of bank credit is required to be financed by an international capital account surplus in the form of increased foreign debt and the sale of Australian capital assets. One of the challenges that continue to face the Australian economy is how to balance the current account.

3.8 Fiscal surpluses have had no effect on this outcome as shown in Figure 1. Neither is there any evidence to show that savings polices such as compulsory superannuation have had any effect in changing the current account deficit. Even competition policy has been ineffective at addressing this matter.

4. Financial instability

4.1 The rate of growth of bank credit in Australia has been exceeding the rate of growth of GDP, as shown in Figure 2. Figure 2 also compares the ratios of bank credit to GDP in Australia with those for the USA and the UK. It reveals that Australia’s debt to GDP ratios are growing in a similar manner to those of the USA and UK. However, Australia has not yet reached the ratio of debt to GDP experienced in the USA and the UK at which the financial system collapsed.

Figure 2. Ratio of Bank Credit to GDP for Australia, USA and UK[3]

4.2 Bank credit and the money supply have been growing faster than the economy because money is required for transactions to service the growing debt burden as well as to buy and sell products. The requirement for money to be diverted to service debt reduces the money available to buy products which, in turn, reduces GDP below the level it would otherwise have been. Therefore, the growing debt, together with the constrained growth in GDP, has inflated the debt burden.

4.3 The debt burden can be defined as the ratio of debt to GDP. Figure 3 provides a graph of the relative growth of bank credit[4] and nominal GDP, together with a graph of the relative growth of the debt burden (the ratio of bank credit to GDP) and prices in Australia. Essentially, the growth in the relative burden of debt can be put as:

Bt/Bo = (Lt/Lo)/(Ynt/Yno) (2)

Where Bt is the debt burden at time “t”;

Bo is the debt burden at time “o”;

Lt is bank credit (liquidity) at time “t”;

Lo is bank credit (liquidity) at time “o”;

Ynt is nominal GDP at time “t”; and

Yno is nominal GDP at time “o”.

Figure 3. Australia: growth of the debt burden[5]

4.4 Equation (2) showing the effect of the change in nominal GDP, can be rewritten to show the effect of a change in real GDP by taking out the effect of price changes. That is:

Ynt/Yno = (Yrt/Yro).(Pt/Po) (3)

Where Pt are prices at time “t”;

Po are prices at time “o”;

Yrt is real GDP at time “t”; and

Yro is real GDP at time “o”.

4.5 By substituting equation (3) in equation (2), it is possible to conclude that the rate of growth of bank credit (the money supply) is equal to the rate of growth of the debt burden, times the rate of inflation, times the rate of growth of real GDP. That is:

Lt/Lo = (Bt/Bo). (Pt/Po).(Yrt/Yro) (4)

4.6 Equation (4) is similar to the quantity theory of money. It differs only in that it assumes the velocity of circulation to be stable (equal to 1) and that total transactions are explicitly stated to comprise transactions related to production and debt servicing. Figure 3 reveals that the debt burden has been growing at a similar rate to inflation. It highlights the need to reform the financial system to ensure that the debt burden does not continue to grow into a financial crisis.

4.7 From equation (4) it is possible to show that the debt burden and inflation are dependant upon the ratio of the growth in bank credit (and the money supply) relative to the real growth of the economy.

(Bt/Bo). (Pt/Po ) = (Lt/Lo)/(Yrt/Yro) (5)

4.8 Equation (5) reveals that if bank credit is used to fund expenditure that does not raise GDP, such as to finance the purchase of existing real estate, then it will raise the debt burden and/or inflation. Alternative, if money were to enter the economy from international trade, such as export growth, it would raise the money supply and GDP simultaneously. Any increase in the money supply that directly increases GDP by a similar, or greater, magnitude is unlikely to contribute to inflation and the debt burden.

4.9 The latter effect is evident in Figure 2, before 1983, when international transactions were allowed to affect the money supply, the debt burden in Australia was relatively stable. The debt burden has grown only since the exchange rate was floated and the money earned from increased international trade was prohibited from contributing to the money supply.

4.10 Bank deregulation and floating the exchange rate appear to have had a beneficial effect on the financial system and the banking system, in particular. Without the need to restrict bank credit to preserve foreign reserves, bank lending has grown at a much faster rate than the economy.

4.11 This unbalanced growth in bank credit relative to the economy has caused debt to grow much faster than the capacity of the economy to repay that debt. If this is allowed to continue, eventually, the burden of debt will exceed the capacity of the economy to service it, causing the financial system to collapse, as in the USA, UK and Europe.

5. International competitiveness

5.1 The floating exchange rate system ensures “monetary independence” by taking all the local currency that Australians spend on imports[6] and using it to buy all the foreign currency entering Australia from exports and foreigner investors. The foreign currency is then used it to pay the foreign suppliers for Australia’s imports. All the Australian currency stays in Australia (to pay exporters and foreign investors) and all the foreign currency is spent overseas (on imports, etc). The exchange rate adjusts to ensure that these transactions are trued up, or are balanced.

5.2 If some sectors of the Australian economy increase their exports, then the additional foreign currency raises the demand for Australian currency on the foreign exchange market. This inflates the exchange rate to make imports cheaper. The cheaper imports make Australian products less competitive so that domestic consumers stop buying domestic products and buy imports instead. That shift to imports has devastated many Australian industries. Manufacturing in Australia has declined from 12.1% of GDP in 1983 to 6.8% in 2013. The recent announcement of the closure of Ford, Holden and Toyota assembly plants in Australia are further evidence of an exchange rate system that has inflated exchange rate to the detriment of the Australian economy.

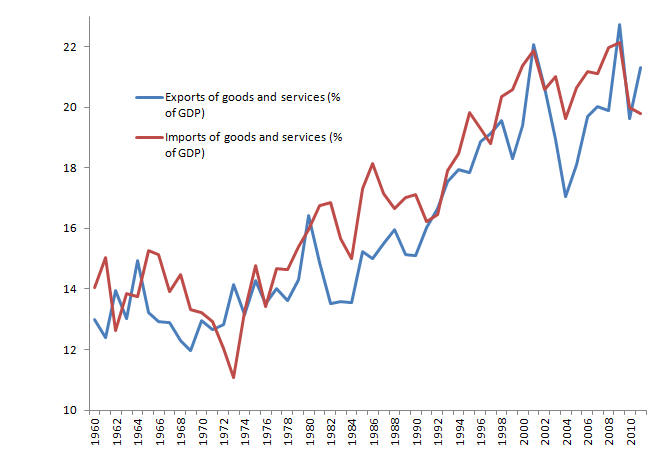

5.3 The high exchange rates have reduced the incomes not only of import competing industries, but also of export industries, including agriculture and mining. Instead of exports generating additional income for Australia, it has generated additional income for foreign industries by raising imports in Australia. This is evident in Figure 4 which shows exports and imports have been growing relative to GDP. Up until the time the exchange rate was floated, export growth stimulated the economy and the economy grew together with exports. During that time, exports were usually between 12 and 14 percent of GDP. After the float, the growth of exports could no longer directly stimulate economic growth. Instead exports have stimulated imports at the expense of Australian economic growth. Consequently, both exports and imports have increased as a share of GDP.

Figure 4. Australia: Exports and imports as % of GDP[7]

5.4 This outcome was not the consequence of any inefficiency on the part of Australian industries and workers. Rather it was the direct effect of the “reform” of the financial system. Even so, Australian industries were blamed for their inability to compete with the rising level of imports. Government initiatives such as “competition policy” were implemented to “solve the problem”. The targeted industries were often the victims of the exchange rate system which had undermined them by making imports cheaper.

5.5 The collapse of Australian industries made many of them targets for takeover, particularly foreign takeover. As these industries were being blamed for their own demise, foreign takeovers were perceived as revealing the success of the market system, rather than being the consequence of market failure.

5.6 The high exchange rates generated by the floating exchange rate system has made Australia less internationally competitive and reduced the amount of exports from Australia. That has reduced Australia’s foreign income and, in turn, has reduced Australia’s demand for imports below what it otherwise would have been. Hence, the exchange rate system has reduced total international trade, although it has increased international trade’s share of GDP. Not only have Australia’s trading partners suffered from lower exports to Australia, but Australia’s GDP would have been at least 50 percent higher[8] than it is now, had exports been allowed to generate additional income for the Australian economy. If GDP had been allowed to grow with international trade, as in the past, it is unlikely that fiscal deficits would be a political and economic issue.

6. A well-functioning financial system? - mortgages and house prices

6.1 In the days when bank lending was restricted, banks embraced short-term loans with higher interest rates. But when the restrictions were lifted, banks were given unlimited powers to create additional money. Banks took advantage of these new powers to create money and in the late 1980’s bank credit was growing at a rate of more than 30 percent per annum. Much of this money was being used to fund mortgages to speculate on house prices. People were investing in housing, not for the rent they could earn but for the capital appreciation. During this period, house prices were doubling in less than 5 years. Early investors were able to buy houses cheap and make huge profits within a few years. But as house prices increased it became more difficult for new entrants to enter the market. This threatened to bring about the collapse not only of the housing market, but of the economy and the financial system.

6.2 To avoid such an outcome, the government stepped in with first home buyers grants to subsidise new entrants to enter the housing market. The economy had become dependant upon the growth of bank lending and if insufficient numbers of home buyers take out new mortgages, then the rate of economic growth declines.

6.3 In the USA, Europe and the UK, the financial system collapsed, just like a Ponzi scheme, when there was a shortage of new entrants entering into home mortgages. Despite policies to encourage new buyers into the housing market, these economies ran out of new investors willing to take on more debt. Consequently, the housing market collapsed, taking the financial sector with it. As previously stated and shown in Figure 2, Australia’s debt burden has not yet reached the level at which the USA and UK financial system collapsed. To preserve the stability of Australia’s financial system, the ratio of debt to GDP should not be allowed to approach the levels reached in the USA and UK.

6.4 The critical peak[9] in the debt to GDP ratio may be lower for Australia than the USA and UK. For example, the US tax system treats home mortgage interest charges as a tax deductable expense, whereas Australia only treats interest on investment homes as tax deductable. Therefore, the capacity of Australian borrowers to service loans may be lower than the capacity of US borrowers. For this reason, it would be risky for Australia’s debt to GDP ratio to rise any higher.

6.5 One of the issues being considered in this financial inquiry is whether the government should allow banks to collapse when, as in the USA, UK and Europe, borrowers can no longer afford to service their debt. This is a dilemma that Australia should avoid. It is a dilemma that cannot be avoided by ensuring the prudent management of individual banks: it is a macro-prudential problem requiring the prudential management of the whole financial system.

7. Financial stability and funding growth

7.1 Australia needs to learn from the mistakes of the USA, UK and Europe and establish a more stable and sustainable financial system. That does not mean a return to excessive bank regulation and fixed exchange rates.

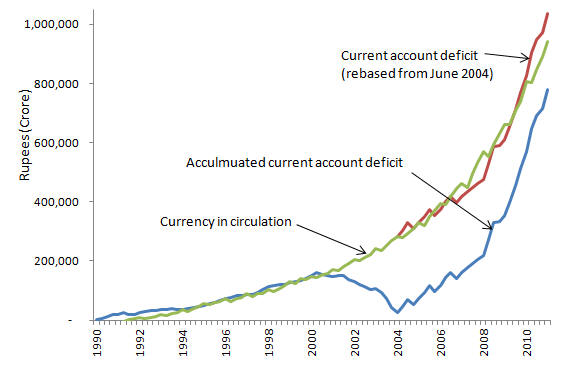

7.2 An example of the type of financial policy that could succeed was inadvertently applied in India. Between the December quarter 2000 and the June quarter, 2004, the Reserve Bank of India intervened in the foreign exchange market to stabilise India’s exchange rate. During that time, India experienced large current account surpluses as shown in Figure 5.

Figure 5. India: Current account deficit and currency in circulation

7.3 The growth of bank credit in India did not deplete its foreign reserves during the period that the Reserve Bank of India intervened in the exchange rate. Thus, India did not need the floating exchange rate system to ensure international receipts and payments were equal. If Indian bank lending had been regulated to preserves India’s foreign reserves, those regulations would not have been binding on bank lending.

7.4 By 2004, the Indian economy was prospering again and the Reserve Bank of India was persuaded that the economy had recovered sufficiently for the exchange rate to be allowed to fully float again. However, if the exchange rate had not been floated again, it is likely that the economy would have grown more rapidly. Rapid economic growth would have raised Indian demand for investment and finance. Therefore, refloating the exchange rate is likely to have slowed not only the growth of the real economy, but also slowed the growth of the financial sector.

7.5 Australia initially adopted the floating exchange rate system during a crisis in which its official foreign reserves were being depleted. But, as in India, the conditions that generated that crisis and the policy change no longer exist. Rather, Australia has been suffering from an inflated exchange rate: an environment that would have raised foreign reserves and stimulated the economy, if the Australian economy were open to money from international trade.

7.6 Therefore, the current exchange rate system is constraining the growth of the Australian economy and the financial sector. Australia would be more prosperous if it had an exchange rate system that was open to the additional foreign income being generated by the growth of exports. Such a prosperous economy would require more capital to finance the investment than is currently being demanded. Therefore, prosperity in the real economy would raise demand for the services of the financial sector. In such an economic environment, bank credit could increase without raising the debt burden and threatening the stability of financial system.

7.7 Yet any change in the financial system would need to ensure that the growth of bank credit did not get out of hand, causing international receipts to exceed international payments and again threaten the stability of the financial system. This can be achieved simply by amending existing guidelines regulating bank lending. Under the current guidelines, banks are required to show that they hold adequate liquidity. If those liquid assets requirements were redefined as foreign financial assets, then bank lending would grow only as bank holdings of foreign financial assets increased. This could take the form of guidelines that authorise banks to increase their lending by, say, A$10 for every US$1 increase in their net foreign financial assets.

7.8 Under a financial system open to monetary growth from international trade, such a policy would uphold the principle of reciprocal trade. If Australian exports were to increase by, say, US$125 million, the additional foreign income would be converted into Australian currency and flow into the economy. Let us assume 20% was spent immediately on imports, so that the net rise in foreign reserves was US$100. All the remaining additional money flowing around the economy would have been earned as a direct result of reciprocal trade. That is, the additional money in the Australian economy was earned by raising income by trading products.

7.9 While that money was circulating around the Australian economy, facilitating transactions, as far as the rest of the world is concerned, the additional US$100 million in Australian foreign reserves represents money that Australia has saved. Provided there were foreign reserves available to meet the demand for imports as they occurred, the banks could lend those national savings and facilitate investment in the economy without taking away any entitlements from those who had earned their money from reciprocal trade.

7.10 Applying the ratio of bank credit to foreign reserves proposed in paragraph 7.7, the banks would be able to increase their lending by $1,000 million if they could preserve foreign reserves at US$100 million. However, as they increased their lending, they would generate additional imports and they are likely to find that by the time they had lent A$100 million, the additional foreign reserves would have been depleted to US$10 million. At that point, they would have reached their lending limit and not be able to increase their lending until they had accumulated more foreign reserves, or national savings. Under this scenario, bank lending would be associated with rising foreign reserves, not increased foreign debt.

7.11 Also, bank lending is unlikely to raise the debt burden because lending can grow only as income grows. The money that was originally earned from exports that had not been spent on imports continues to be in circulation. But, as explained in paragraph 7.10, most of the foreign exchange that created that money in the first place would have been used to pay for the imports generated by the growth of bank credit. The bank loans continue to appear as assets on the banks’ balance sheets while the money (a bank liability) created by the bank lending has been eliminated from the balance sheet when it was spent on imports. The net effect of these transactions is that bank lending has replaced foreign reserves as the asset on the balance sheet of the financial system, offsetting the liability of the money in circulation that was generated by increased foreign income. The money in circulation would have existed even if there had not been any bank lending. In such circumstances, the financial system can finance increased investment yet maintain financial and economic stability.

8. Ensuring economic competitiveness

8.1 The issue still remains how to manage the exchange rate. The following approach was developed within the Australian Treasury in the late 1980’s. The strategy is to create incentives for the financial market to drive the exchange rate to a level that would attain full employment. The exchange rate is required to ensure that Australian products are sufficiently competitive for demand for them to generate full employment without causing inflation. The strategy essentially makes an economic environment of full employment and prices stability the most profitable environment for the financial sector.

8.2 To provide incentives for full employment and price stability, the capacity to banks to lend is linked to the level of unemployment and inflation. For example, assume that it is government’s objective is to reduce unemployment to less than 3 percent and inflation to less than 2.5 percent. Then banks would be authorised to increase their lending by A$10 for every US$1 increase in their net foreign reserves, as described in section 7 above, but only while government’s targets were being met. For every one percent, or part thereof, that unemployment exceeded 3 per cent or inflation exceeded 2.5 percent, the capacity of banks to lend relative to each US dollar equivalent increase in their foreign reserves would be reduced by a dollar. Thus, if unemployment were 5.5 percent and inflation 3 percent, banks would be authorised to increase their lending by A$6 for every US$1 increase in their net foreign reserves.

8.3 Banks make profits by lending money: not by holding foreign assets. In order to maximise their more lucrative lending assets relative to their foreign reserves, the financial system would drive the exchange rate down to a level that would attain the government’s employment target, and do so in a manner that would minimise the inflationary effect.

8.4 While the objectives and procedures of monetary policy are beyond the scope of this inquiry, the proposals in this submission have implications for monetary policy. The Reserve Bank of Australia currently conducts monetary policy to attain price stability. The proposed reforms to the financial system would manage price stability. Therefore, there would be no need for the Reserve Bank to use interest rates as an instrument of monetary policy. In that case, interest rates could be set by the market to manage the growth of credit. For example, if demand for credit exceeded the capacity of the banks to lend, the market could raise interest rates to contract the demand for loans and increase domestic savings. Also, the higher interest rates would attract foreign capital that would raise banks’ foreign reserves, enabling them to increase their lending. Once the demand for loans was met, the need for foreign capital would be reduced and interest rates could return to their long term stable and sustainable levels.

8.5 The Reserve Bank of Australia Act, 1959, states that the duty of the Reserve Bank Board is to ensure that the monetary and banking policy is directed to the greatest advantage of the people of Australia. The Board is also required to exercise of its powers in such a manner that would best contribute to the stability of the currency, the maintenance of full employment and the economic prosperity and welfare of the people of Australia. This submission proposes reforms to the financial system that would need to be administered by the Reserve Bank and its Board. These reforms would enable the Reserve Bank Board to perform the duties for which it was established.

8.6 As explained above, the experience of other economies with financial systems similar to Australia’s system is that eventually the debt burden rises to a level that causes it to collapse. Australia is doomed to a similar fate if it continues to operate the current system. If this inquiry recommends policies that act to curtail the growth of the debt burden, it risks the possibility of causing Australia to follow Japan into a period of slow economic growth. This submission proposes a framework for a stable, sustainable and well-functioning financial system able to meet the demands of a growing and sustainable economy. It is a system that would raise GDP and address many of the problems in the Australian economy. For example, the increased tax revenue from the increased incomes and employment would reduce, if not eliminate, the fiscal deficit.

9. Competition

9.1 The proposed reforms to banking will have implications for competition between the banks and between the banks and other parts of the financial sector. To foster competition between the banks, it is proposed that each bank hold its foreign reserve account (required to manage the growth of bank credit) with the Reserve Bank. Also, it is proposed that inter-bank transfers be settled through these foreign reserve accounts. This means that when deposits are transferred from one bank to another, it would have implications for the balance of each bank’s foreign reserve account and its lending capacity. In this way, banks would be encouraged to compete for customer deposits and not just their mortgages and other debts.

9.2 A stable and sustainable well-functioning financial system is likely to avoid loans that inflate the price of real estate. The financial system is more likely to use long term savings, such as superannuation funds, to finance home loans. Also, there is no need for the proposed macro-prudential policies to be applied to non-bank financial institutions because they are financial intermediaries that lend savings: they do not create additional money when they lend. The lower level of regulation of non-bank financial institutions would provide them with the opportunity to provide more dynamic and innovative services.

10. Conclusion

10.1 The financial system in Australia has been allowed to abuse the monetary system for its own purposes. This has enabled it to grow at a faster rate than the rest of the economy. But it has also been at the expense of the rest of the economy. This submission has provided evidence that the abuses of the past are now threatening the stability and sustainability of the financial sector.

10.2 The opportunity now exists for this Financial System Inquiry to consider the options for the Australian financial system with the benefit of hindsight; seeing what has happened in Australia and overseas.

[1] The graph also reveals that the fiscal deficit is unrelated to the current account deficit. Note that the Reserve Bank of Australia changed its published banking statistics in 2002. This meant that some irrelevant assets were included which overstated the growth of bank credit as is evident in the graph after 2002. Note also that savings and other government policies had no effect on the relationship between the current account deficit and the growth of bank credit.

[2] The solution, together with an explanation of the problem, was presented to the Economics Society Conference in Adelaide in 1995. The papers are available at: http://www.buoyanteconomies.com/PAPER1.pdf , http://www.buoyanteconomies.com/PAPER2.pdf and http://www.buoyanteconomies.com/PAPER3.pdf .

[3] Source: World Bank Statistics “Domestic credit provided by banking sector (% of GDP)”

[4] The same bank credit shown in Figure 1. Because international transactions are prevented from affecting the money supply, the growth in bank credit also represents the growth in the supply of money.

[5] Source: RBA Statistics. The statistics showing calculations and chart are available on the “Growth” worksheet of the spreadsheet available at www.buoyanteconomies.com/UnendowedMoney.xls.

[6] The term “imports” is used here to include all current and capital payments.

[7] Source: World Bank statistics.

[8] In 1983, exports were 13.4% of GDP and in 2013 they were 20.4% of GDP: that is more than 50% higher as a share of GDP. If the exchange rate had not been inflated and Australian exports had remained at 13.4% of GDP, then GDP in 2013 would have been more than 50% higher.

[9] The critical peak is the level at which the debt burden exceeds the capacity of the economy to repay its debt and the financial system collapses.

Last update: 13 April 2014