Buoyant Economies

Stimulating the UK economy while providing monetary and financial stability

The economic and financial crisis in the UK is not unique to the UK. Similar problems exist in Europe and the USA.

To explain the cause of this crisis it is necessary to take a macro-economic perspective. This paper uses simple diagrams to explain the problem and present a solution. The proposed solution applies 3 staged strategies. The first is intended to reduce the immediate pain of the crisis; the second is a transitional stabilising strategy; and the third is a sustainable strategy for the long term.

The UK monetary system operates in the environment of freely floating exchange rates. That exchange rate system delivers an exchange rate that ensures that the domestic money supply is independent; that is, international monetary flows do not affect the money supply.

This closed monetary system is not introduced to help the growth of the whole economy. It was applied during a crisis to protect the foreign reserves of the banking system. Not only does it prevent foreign reserves being depleted, it also diverts foreign income away from the economy so that the funds do not add to foreign reserves and domestic incomes. By isolating money from foreign sources, it means that international trade no longer stimulates the economy. The only source of monetary growth to stimulate the economy is from the growth of bank credit. That credit can can finance either government, or private sector, expenditure.

Another way of interpreting the floating exchange rate system is that it prohibits national savings, in the form of increased official foreign reserves. That is, export incomes cannot exceed import payments, unless the private sector goes out of its way to save overseas, as in Japan.

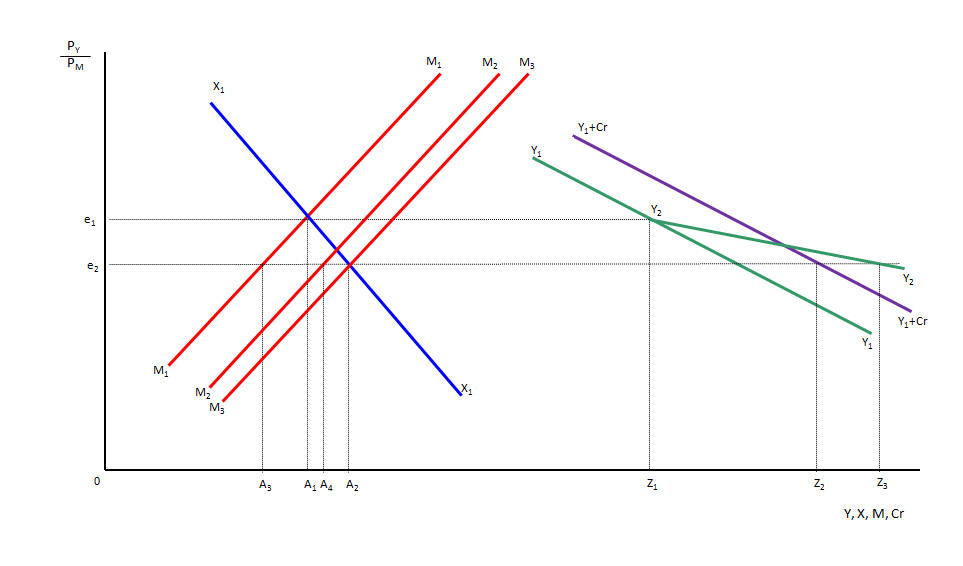

Figure 1. Floating exchange rate with export growth

Figure 1 represents the current UK monetary economy. On the vertical axis is the real exchange rate. It represents the ratio of the price of domestic products relative to the price of imports. A high exchange rate in this model means that the prices of domestic products are high relative to the prices of imports. National income, export and imports are presented along the horizontal axis. There is no bank lending in the initial model presented in Figure 1.

National income is at Z1 and export income is given by the line X1- X1. While the level of national income is at Z1, the demand for imports is given by M1- M1 line. The market determines an equilibrium exchange rate at “e1” at which imports and exports are equal and are represented by the interval the O-A1 on the horizontal axis. National income is made up of exports (O-A1) and income from sales to the domestic economy (A1- Z1).

We now assume that the supply of exports rise from X1-X1 to X2-X2. As a result, the exchange rate rises from “e1” to “e2” to maintain equilibrium between imports and exports. Consequently, exports rise from O-A1 to O-A2. There has been no increase in income because at the higher exchange rate, imports have increased from O-A1 to O-A2 and the income from sales to the domestic economy has declined from A1-Z1 to A2-Z1.

This modelled outcome reflects the experience of the UK economy. For example, the exports of the UK have increased from 21 percent of GDP in 1972 (when the UK floated its exchange rate) to 32 percent in 2011,[1] a relative increase of more than 50 percent. Similarly, imports have increased from 21 percent of GDP in 1971 to 31 percent in 2011. This growth in exports and imports relative to GDP is frequently called “globalisation”. It means, also, that the relative size of the import competing sector of the economy has declined. For example, the relative size of manufacturing in the UK has declined from around 30 percent of GDP in 1972 to 11.4 percent in 2010. These structural changes in the economy are the result of an exchange rate system targeted to achieve "monetary independence", or a closed monetary system.

In Figure 2, this simple model of the UK economy is expanded to include the growth of bank credit and foreign capital inflows on the horizontal axis. In this case, credit growth, “Cr”, raises national expenditure from Z1 to Z2. As a result, demand from imports shift from M1-M1 to M2-M2.

It should be noted that money usually constrains expenditure to income. That is, the income people earn from selling products entitles them to buy products of an equivalent value.

If someone who has earned money lends their money to someone else, the lender is forgoing their expenditure to allow the borrower to lend. But when banks increase the total amount of their lending, no-one is forgoing any expenditure: the banks are creating additional money. When everyone who has earned money, spends their money, they are buying the equivalent of what they have produced. When additional money from bank credit is spent, it can cause the economy to buy more than it has produced, if there is no corresponding growth in national savings.

The only way a country can buy more than it produces is to import more than it exports. Under the floating exchange rate system, the only way that imports can exceed exports is if there is capital inflow. The amount of capital inflow is equal to the amount by which imports exceed exports. Imports exceed exports by the amount that national expenditure exceeds national income. National expenditure exceeds national income by the growth of bank credit less national savings.

In the Figure 2 model, there are no additional national savings and the foreign capital inflow. Capital inflow, “K1”, is needed to finance the additional imports and is shown as an additional source of foreign exchange in the line X1+K1 - X1+K1. It intersects the new import schedule at A2 with a new equilibrium exchange rate of “e2”.

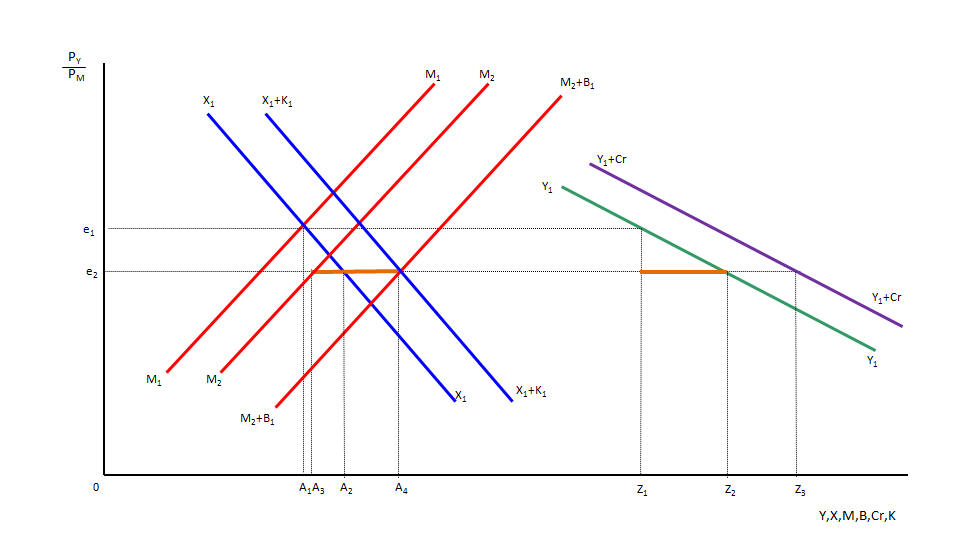

Figure 2. Floating exchange rate with Credit growth

The creation of the additional bank credit is likely to raise demand for domestic products and thereby raise domestic income. This is shown as a rise in income from Z1 to Z3. Part of the money from bank credit is spent on domestic products. This raises national income. The remainder of the money is spent on imports. These imports do not raise national income. But the growth of bank credit represents a rise in domestic debt. It has been the experience of the UK that bank credit (domestic debt) has been rising faster than national income.

The rise in national income is a good indicator of the increase in the economy’s capacity to service debt. If domestic debt is growing faster than the economy’s capacity to service that debt, then the financial system is unstable.

The financial system may appear stable for many years. However, eventually the burden of debt will reach or exceed the economy’s capacity to service that debt, leading to a debt crisis such as experienced in the USA and the UK since 2008.

Any strategy for a stable monetary and financial system for the UK must ensure that the rate of growth of bank credit (or domestic debt) does not exceed the rate of growth of national income.

It should be noted from Figure 2 that the amount by which imports exceeds exports (the interval from A3 to A2) represents an increase in foreign debt (and/or foreign equity). The growth of foreign debt creates an additional debt burden on the economy. The growth of that foreign debt needs to be addressed, also, if the financial system is to be stable.

The proposed approach to establishing a stable financial system involves using the foreign exchange market to stimulate the economy in a manner that ensures that the economy grows faster than debt. The simplest form of this strategy is presented in Figure 3. Initially exports and imports are equal at A1 and national income is at Z1 with the exchange rate at “e1”.

Figure 3. Initial strategy for financial stability excluding bank credit

Direct Intervention

The most immediate action that can be taken (before a longer term strategy can be approved and implemented) is for the Bank of England to intervene in the foreign exchange market to sell domestic currency and buy foreign exchange. Initially, the Bank could spend say, GBP 500 million per week on purchasing foreign exchange. That would be sufficient to increase the GDP by about 1.5% per annum. It could raise this rate if further stimulus was required.

Alternatively, the government could apply fiscal policy to achieve the same outcome. For example, it could sell government securities directly to commercial banks. The new money that it collects from the banks would be put on the foreign exchange market and used to purchase foreign currency to purchase foreign government securities. The fiscal policy does not raise the fiscal deficit because the government bonds are being used to purchase foreign government securities which would be part of the government's savings. That is, the debt is being used to purchase savings.

The effect on the economy of such policies is shown in Figure 3 where the increase in the supply of domestic currency on the foreign exchange market is shown as the M1+B1 - M1+B1 line. This intervention shifts the equilibrium exchange rate on the foreign exchange market from “e1” to “e2”. At this lower exchange rate, exports rise from A1 to A2. Also, imports fall from A1 to A3. The expenditure that had been on imports is shifted to domestic products, increasing domestic demand and output from A1-Z1 to A3-Z1. The additional contribution to national income from exports represented by the interval A1-A2 and the additional demand for domestic products is represented by the interval A3-A1, which raises national income from Z1 to Z2.

The net effect of this is that national income and the money supply have been raised without raising net debt.

The traditional approach to stimulating the economy by raising bank credit raises domestic debt. There may be good reason to avoid further growth in UK domestic debt at this stage. This matter is considered in the model discussed in Figure 4 which is similar to the example considered in Figure 3 except that it includes an increase in bank credit.

In Figure 4, bank credit raises national expenditure above national income. This expenditure schedule is shown as the Y1+Cr - Y1+Cr line. The additional expenditure from bank credit (Cr) shifts the import schedule from M1-M1 to M2-M2. The Bank’s, or government's, intervention in the foreign exchange market adds to the total supply of domestic currency on the foreign exchange market which is represented by the M2+B1 - M2+B1 line. These activities shift the equilibrium exchange rate from “e1” to “e2”.

Figure 4. Initial strategy for financial stability including bank credit

As in the previous example (shown in Figure 3), exports increase from A1 to A2. However, in this case imports increased slightly from A1 to A3. Domestic demand for domestic products increases, raising output from A1-Z1 to A4-Z3. The foreign capital inflow (comprising the increase in foreign equity and foreign debt) is represented by the interval A2-A4. As the growth in foreign reserves, or foreign bond holdings, (represented by the interval A3-A4) is greater than the increase in foreign debt (represented by the interval A2-A4), we can say that there has been a reduction in net foreign debt or an increase in net foreign reserves. However, the increase in the total money supply, represented by the interval Z1–Z3 is greater than the growth in national income, represented by the interval Z1–Z2. Therefore, the money supply has increased by more than the growth in income. Allowing bank credit to grow in this manner could be inflationary.

For that reason, intervention in the foreign exchange market can only be a trial or a short-term remedy designed to stimulate the economy. If inflation is to be constrained during this period, the growth of bank credit may need to be constrained.

Guided Exchange Rate System

The second step in the strategy is a transitional arrangement designed to allow the Bank of England to guide the financial system towards stability and lay the foundations for a financial system that is stable and sustainable in the long term. Although it allows the market to determine the exchange rate, there is provision for the Bank of England (or HM Treasury) to guide and set a cap on the exchange rate in a manner that does not impose any risk to the Bank of England.

Under this guided exchange rate system, the Bank of England would require banks to hold a management account with the Bank. Each bank’s capacity to provide additional credit would be linked to the growth of deposits in these accounts. For example, banks may be allowed to lend an additional ten pounds for every addition pound in their management account.

Banks would be required to use foreign exchange to purchase sterling deposits to add to their management account. The Bank of England would sell the domestic currency to be deposited into these accounts at an exchange rate that it would specify. Also, the Bank of England would buy the domestic currency held in these accounts at the specified exchange rate. This system requires that banks be prohibited from raising foreign debt or selling foreign assets to purchase additional foreign currency.

Bank purchases of currency (notes and coins) would be made with funds from each banks' management accounts. Also, interbank settlements would be made through these management accounts.

The Bank of England's specified exchange rate would put a ceiling or cap on the exchange rate. If the spot market exchange rate were higher than the Bank of England’s specified exchange rate, the commercial banks would take their foreign exchange to the Bank of England and increase deposits in their management accounts. This would allow them to convert foreign currency assets to domestic currency assets at the Bank's specified exchange rate.

This approach does not mean that the Bank of England is fixing the exchange rate for all currency. It is only offering to buy and sell funds in the management accounts at the specified exchange rate. It would be holding as reserves the foreign exchange used to purchase the deposits in the banks’ management accounts. Therefore, the Bank of England would be fully hedged against its foreign exchange commitments.

If the Bank had initially intervened in the foreign exchange market as proposed for in the first stage, it would have affected the exchange rate. In the process, the Bank would have gained some experience of the effect of its intervention upon the economy. This would provide the Bank with a basis for determining the initial exchange rate to be applied to funds for the management accounts to generate the desired level of monetary growth. The Bank of England’s exchange rate ceiling would be regularly reviewed and revised as required.

The desired effect of this policy is presented in Figure 5.

Figure 5. Transitional strategy for financial stability

The economy is assumed to be initially at equilibrium with the exchange rate at “e1”, exports and imports at A1 and national income at Z1. The Bank of England sets it exchange rate for funds for the banks’ management account at “e2”. The Bank of England’s exchange rate drives the market exchange rate down to “e2” and exports expand from A1 to A2 while imports contract from A1 to A3. As exports are greater than imports, the banks start earning foreign exchange which they use to raise the deposits in their management accounts with the Bank of England. The additional funds in the banks’ management accounts enable them to create additional bank credit. The growth of bank credit together with the rising incomes (from exports and domestic sales) raises national expenditure to Z2. The increase in national expenditure shifts the demand for imports from M1-M1 to M2-M2. The increase in imports reduces the growth in the banks’ accumulation of foreign reserves as reflected in the declining gap between exports at A2 and imports at A4. The need for foreign exchange to pay for imports may require banks to convert some of the funds in their management account back into foreign exchange.

Under this transitional strategy, the economy would move to an equilibrium position at which imports and exports are equal at A2 and national income is stable at Z3. In this process, the growth in national income must be greater than the growth in national expenditure because bank credit can grow only while there are national savings in the form of increased foreign reserves. Therefore, the growth in income must exceed the growth in debt. Also, the strategy reduces net foreign debt in the financial system because it requires the financial system to raise foreign reserves.

With such a strategy, the Bank of England would no longer be able to use interest rates to control inflation because higher interest rates would attract foreign capital which would enable banks to increase their lending. Therefore, it would be necessary to use another instrument to manage inflation.

Inflation could be controlled by varying the amount that banks could increase their lending relative to the growth in their management accounts. For example, if inflation were below the Treasury’s target of 2 percent, then banks would be allowed to increase their lending by 10 pounds for every additional pound in their management account. If inflation were to exceed 2 percent, then the amount that banks would be required to hold in their management account to enable them to lend 10 pounds could be raised by a pound for every additional 1 percent that inflation exceeds the target.

Therefore, if inflation were 4 percent, then banks would require an additional 3 pounds in their management accounts to be able to lend 10 pounds. As banks profit from lending rather than holding funds in their management accounts, they would seek to manage their lending activities to avoid excessive monetary growth that could be inflationary.

Any bank whose management account balances fell below that necessary to meet their outstanding loans would be constrained from issuing any new loans while that state of affairs persisted. It would be only as national savings increased (in the form of additional management account balances and foreign reserves in the Bank of England) that investment (in the form of additional bank credit) would be allowed to grow.

This transitional strategy relies upon the Bank of England guiding the exchange rate to support HM Treasury’s employment and growth targets. It also, requires the Bank to manage interest rates to influence the level of capital inflow. The Bank’s policies may have implications for the rate of inflation and that could result in the commercial banks being penalised for policies over which they had no control.

Optimum Exchange Rate System

Once the financial system was stabilised and sustainable economic growth was restored, it would be desirable to implement the long term strategy for financial stability. This shifts responsibility for exchange rates and interest rates to the financial market. It would eliminate objections from financial markets that they were being unfairly penalised for the Bank of England policies.

Under the long term strategy, the banks’ management accounts would be converted back to foreign exchange and each bank would hold a foreign exchange account with the Bank of England. This places the foreign exchange risk with the banks.

The Bank of England would determine a ratio for the growth of bank credit relative to the growth in the balance of the banks’ foreign exchange accounts. For example, it may allow banks to lend ten pounds for every Euro increase in each bank’s foreign exchange account with the Bank of England. That ratio would be allowed only while HM Treasury’s employment (or growth) and inflation targets were met.

If the employment and/or inflation targets were not met, the ratio of lending to foreign reserves would be reduced. For example, let us assume that HM Treasury’s employment target was an unemployment rate equal to or less than 3 percent and its inflation target was a rate equal to or less than 2 percent. If unemployment were greater than 3 percent, the amount by which banks could lend for every additional Euro of foreign exchange would be reduced by one pound for every one percent of unemployment above the employment target level. If inflation were greater than 2 percent, then the amount by which banks could lend would be reduced by two pounds for every one percent that inflation exceeded the inflation target. (This weighting would put more pressure on the banks to control inflation rather than to lower unemployment.) To maximise their lending and profits, banks would drive the exchange rate to a level that would achieve HM Treasury’s employment targets and do so in a manner that minimises inflation.

This long term approach to attaining financial stability uses a similar strategy to that used for the transitional system and considered in the discussion of Figure 5. The main difference with the long term strategy is that the objective for the exchange rate is made explicit and fully incorporated into the system. This approach is presented in Figure 6.

Figure 6. Strategy for long term financial stability and full employment

As in the previous examples, the exchange rate is initially at “e1” with exports and imports initially at A1 and national income at Z1. The long term stable financial system provides incentives for the financial market to set the exchange rate “e2” at rate at which the equilibrium level of national income is the income that generates full employment: “Yf”.

The incentives built into the system would need to be refined over time. However, this framework provides a means of ensuring that the financial system is stable and that it supports HM Treasury’s employment (and/or growth) and inflation targets.

Only a strategy that balances economic growth with the growth of the money supply and debt can succeed in restoring stability to the UK financial system. The three strategies proposed above are examples of the range of feasible options available to provide financial and monetary stability.

The interventionist approach is widely used among Asian economies. As explained, it is likely to generate higher levels of inflation than HM Treasury is willing to tolerate. Even so, countries that rely on their central banks to intervene in their foreign exchange markets are prospering. Hence, such intervention is a feasible option for the UK.

Another approach is that available to Germany. Germany is able to enjoy a lower exchange rate and prosper from the money generated from its export growth because it shares a currency with other members of the European Monetary Union (EMU). However, the financial system of the EMU is even more unstable than the current system in the UK.

The transitional and long term strategies proposed above allow an economy to prosper from the money generated from international trade, as in Germany, but without the need for other countries to degenerate into poverty and debt. They are strategies that are capable to delivering monetary and financial stability to the UK. They are policies that would reduce unemployment and generate economic prosperity. Government revenue would increase and expenditure on social security would decline with the fall in unemployment, enabling government to earn a fiscal surplus and reduce its debts.

Leigh Harkness

Originally posted 21 November 2012

Last update 2 May 2016

[1] Source: World Bank Data on Exports of Goods and Services (% of GDP). In 2014 (after this paper was originally written), GDP increased relative to exports and improts so that exports were equivalent to 28 per cent of GDP and imports equivalent to 30 per cent of GDP.