Buoyant Economies

The Great Financial Injustice

Growth of Debt and Loss of Income in America

Impact of the floating exchange rate system on debt

Impact of the floating exchange rate system on employment and growth

James Galbraith and others prepared a statement to the US Senate Judiciary Committee, Subcommittee on Crime, apologizing for economists failure to effectively control for fraud in the financial system that led to the global financial crisis since 2008. The fraud he described related to passing on of worthless financial securities (debt).

However, there is a far greater injustice being perpetrated in the guise of legitimate financial transactions. To appreciate that injustice, it is necessary first to understand the role of money in the economy.

Money

Money is a record of our entitlements and obligations. A credit balance with a bank is a record of entitlements. Similarly, cash is a record of entitlements. These are current entitlements. That is, when we spend our money (exercise our entitlements) we expect that money to be honoured.

A debt with a bank, arising from a loan, is a record of an obligation. There cannot be an entitlement without a corresponding obligation or asset.

Silver and gold coins have been forms of money in the past. Trade using coins with an intrinsic value is closer to barter than trade with money in the form that we use it. That is, trade using coins made of precious metals is an exchange of goods (silver or gold for another commodity). It is different from a trade using a trusted recording system such as bank accounts. These recording systems register the ownership and transfer of entitlements (money) for products. Also, they record obligations (debt).

Many people continue to consider modern money as the equivalent of gold and silver. However, if money is badly managed, people quickly lose faith in it.

To effectively manage money, it needs to be kept secure. People who hold cash keep it secure to avoid it being stolen. Also, bank notes have security features to make them difficult to forge.

Bank accounts are trusted records of entitlements and obligations. These need to be kept exceptionally secure. Bank accounts would be useless if people could alter their accounts so as to raise their deposits or reduce their debts. Banks have an extremely important role in securely recording these entitlements and obligations.

Constraining demand to supply

Money serves an important economic role in constraining expenditure to income; consumption to production. That is, the money we earn from producing products for the economy entitles us to buy products from the economy up to the value of the goods we have supplied. If we spend only the money we earned, we could never buy more than we had produced.

This attribute of money is similar to other tickets and tokens. For example, a ticket to a theatre must be constrained to the number of seats in the theatre. If tickets were issued regardless of the capacity of the theatre, the people who had purchased the tickets would feel cheated if there was no room for them. They would ask for a refund and would be reluctant to buy tickets to that theatre again.

If people could just create their own money, they would be attempting to buy more than they produced. But also, if people could create their own money, it would defeat the whole purpose of money. There would be no reason to produce anything to sell so as to earn money to spend. That would mean that there would be nothing available to buy with the money created.

Demand exceeding supply

Banks could abuse their role if they were to, say, register additional deposits in the bank deposit accounts of their owners. However, the double entry nature of our accounting systems control this. A credit entry in the owners’ bank deposit accounts would require a corresponding debit entry raising bank assets or reducing bank debt or owners equity.

If the debit entry were made against owner's equity, the owners would be paying themselves the equity that they already owned. Rules on bank lending often link lending to equity. Therefore, banks that reduced their equity or reserves would be reducing their ability to continue to lend. Hence there is an incentive for bank owners to constrain the amount they pay themselves in that manner.

However, if the deposits registered in the owners' accounts were treated as loans, then the owners could spend that money without significantly reducing their other lending activities. According to the bank’s books, the owners would be borrowing from the bank, which is essentially from themselves. This may seem pointless. But in the real economy, the additional bank deposits are money that would immediately entitle the owners to goods and services without them having to give up anything or contribute anything to the economy.

If banks could, by a simple accounting entry, create money for themselves, then they would be able to buy products from the economy without having first contributed products to the economy. If that were to happen, the banks would be abusing their role in the economy.

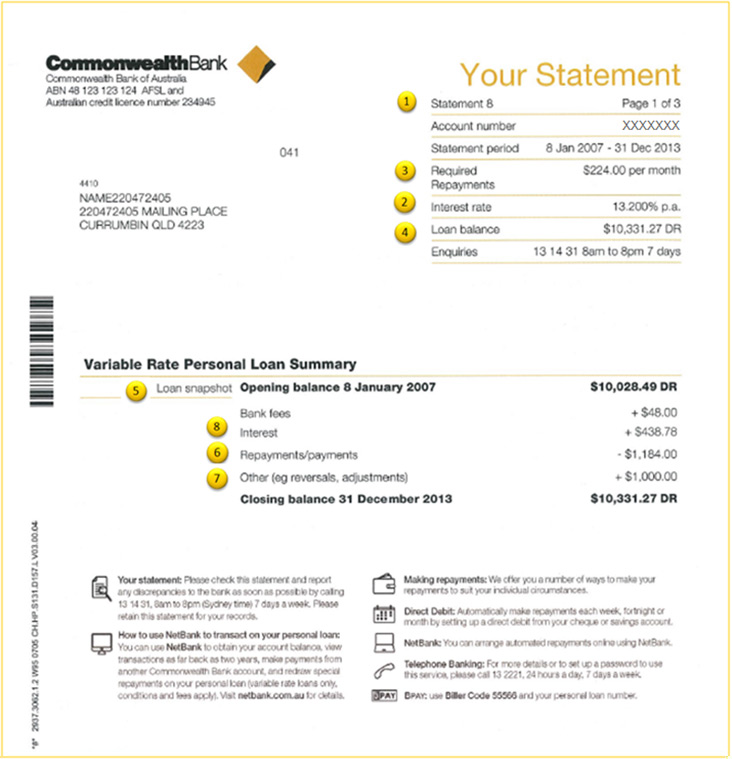

Yet when banks lend, they are essentially doing that. They enter a deposit into the borrower's bank deposit account in exchange for a debt of a similar amount. The bank does not take money out of anyone else's account to lend it to the borrower. It creates additional deposits.

The deposit that the bank creates is an obligation of the bank and it is offset by an asset in the form of a debt from the borrower. Financially, the bank's books are balanced. Similarly, the deposit is an asset of the borrower and that is offset by the obligation in the form of a debt to the bank. The books of the borrower are balanced, also.

Time and money

As discussed above, money is a record of our entitlements. These are current entitlements. That is, when we spend our money (exercise our entitlements) we expect that money to be honoured.

But the bank debt that created that money is unlikely to be a current obligation: it is most likely to be a debt payable at some future date or over many years.

So while the bank is granting current entitlements, these are not necessarily balanced with current obligations. That is, the bank's accounts may be balanced financially but not from an economic perspective, across time. At some future time, borrowers would be required to repay their loans and thereby supply additional products to earn that money.

But until then, the additional money given to borrowers enables raises the demand for products above the production of products in the economy. Those who earned money by supplying products to the economy are entitled to buy products up to the value of that which they have produced. The additional money from bank credit enables the borrowers to buy more products than the economy has produced.

Bank lending could be considered as balanced if new bank lending were equal to loan repayments. In that case, the current entitlements created by the loans would equal the obligation being honoured by the earlier borrowers parting with money (or current entitlements) to repay their debt to the bank.

If new bank loans were greater than repayments of existing loans, then the banks would be continuing to create additional entitlements without there being any obligation to supply additional products to honour these additional entitlement. The banks would be enabling people to buy more goods than the country has produced. This is likely to cause current account deficits, reduce foreign reserves and/or raise foreign debt (see Figure 3).

It is for this reason that throughout most of bank history, bank lending has been highly regulated and constrained.

Bank lending history

In the US, following the expansionary spending of the Second World War, the growth of bank lending had been constrained in the 1950's, except for 1958 which was followed by constraint in 1959 and 1960. In the 1960's, bank credit had been allowed to grow faster, followed by constraint between July 1969 and June 1970. However, as shown in Figure 1, in the early 1970's bank lending grew rapidly.

Figure 1: USA - Annual growth of bank credit (Jan 1948 to March 1973)

Although there were fiscal deficits at that time, most of this was financed by the issue of bonds. It is the growth of bank credit that is most likely to have been the main cause of the collapse of the US gold reserves and the depletion of US foreign reserves.

Figure 2: USA - Bank credit, fiscal deficit, foreign owned assets and the current account deficit

Figure 2 compares the growth of bank credit, the fiscal deficit and the current account deficit. Clearly the growth of bank credit is significantly larger than the growth of the fiscal deficit. Therefore, it is likely to have a more significant effect on the current account balance. Note that the rise in the fiscal deficit in 1968 and again in 1971 and 1972 had no apparent effect on the current account deficit. (Note that the difference between the growth of bank credit and the current account deficit represents lending that was offset by savings. These savings were the exports greater than imports that would have been the outcome if there had been no growth in bank credit.)

Whatever the principal cause, the current account deficit and falling foreign reserves put pressure on the US government to close the gold window, devalue and eventually to float the exchange rate which it did in March 1973.

The Restraining Float

As we have discussed, money is a record of income and entitlement. Floating the dollar meant that the money entering the US had to equal the money leaving the US. In other words, the money that the US earned from exports was required to equal the money it spent on imports. This had the effect of restraining trade in the US economy, preventing it from raising export sales without a corresponding increase in imports. To buy those additional imports, the economy was required to shift its spending from domestic products to imports. This reduced purchases of domestic products.

This caused the rate of economic growth to decline. As "high tech" industries increased their exports, the exchange rate adjusted to make imports cheaper and restrain US manufacturing industry from competing. This caused them to collapse. What was once the heart of US industry was transformed into a rust belt. (See The Impact of Floating Exchange Rate System on Employment and Growth).

Yet many economists would consider the demise of manufacturing industry to be a fair and reasonable outcome of an effective market. They consider the current account deficit to be the outcome of people behaving rationally in their own best interests. They consider the economy to be open to free trade and the exchange rate to be fair and reasonable.

Many economists have now accepted that it is reasonable to restrain the economy so that the money entering and leaving the economy must be equal. But this means that trade is being restricted to achieve that monetary outcome. It is an outcome that prevents the economy prospering from trade. It is an outcome that slows economic growth because it makes imports cheaper and local products uncompetitive.

The economists that defend the current failing monetary system attribute the trade imbalances to the inefficiency and low productivity of industries and workers. However, the trade imbalances, the collapse of industries and the rise of foreign debt is not the result of US industries and workers being unproductive or inefficient. The industries in the countries that have displaced them in many cases have been less efficient and less productive.

Rather, it has been the floating exchange rate system that has tilted the playing field against domestic manufacturing industries. These industries, and the workers in them, are the victims of a system designed to prevent money leaving and entering the economy. It is a misguided system that stops the economy prospering from trade.

Debt Dependence

Also, by preventing the economy from earning additional money from exports, the US has become dependant upon bank credit to increase the money supply and stimulate the economy. Yet as we have seen, bank credit is a source of money that causes domestic spending to exceed domestic production so that imports must exceed exports, leading to current account deficits that raise foreign debt.

Also, it increases inflation. This leaves those managing the economy in a dilemma, having to trade off economic growth with external and internal stability.

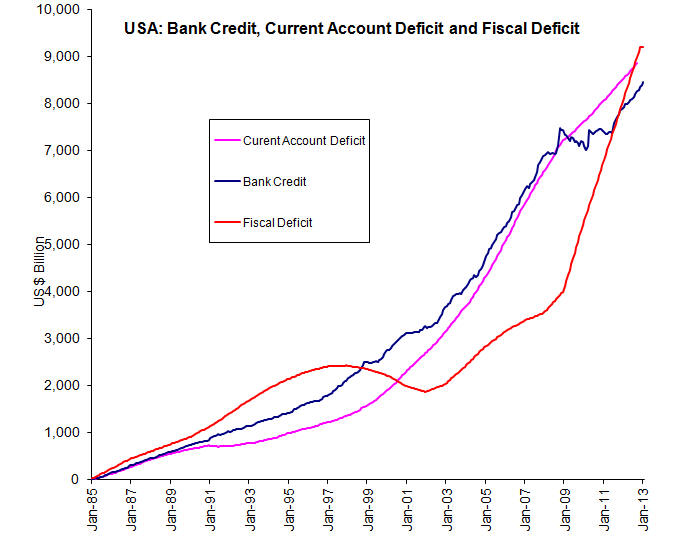

Figure 3 shows the close relationship between the current account deficit and the growth of bank credit. It is clear that the current account deficit does not follow the fiscal deficit.

Figure 3: USA - The source of excess demand creating the current account deficit

As people and businesses must hold money not only to purchase goods, but to pay both domestic and foreign debt, bank credit must grow faster than GDP just to sustain the economy. If debt must grow faster than the rate of growth of the economy, it means that debt must be growing faster than the ability of the economy to sustain that debt. Thus the growth of debt is unsustainable. (See: Money and Unsustainable Debt.)

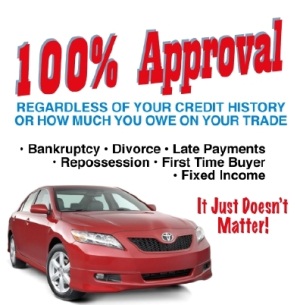

As domestic debt grows and existing borrowers become saturated with debt, financial institutions must look for new borrowers. That is likely to result in financial institutions lending to people who are less able to repay. Banks need to keep on lending otherwise it will cause a recession. If there were a recession, then even more people will not be able to repay their debts. Therefore, banks are caught in a Catch 22 situation.

Conclusion

We have seen that the banks have a significant role in the economy to keep money secure. But they have abused that role, forcing changes to the monetary system that has been extremely damaging to the economy. The growth of bank credit has affected the whole economy, turning it from prosperity into insolvency. The devastating effect on industries and the economy has been far greater than the injustice of selling worthless financial instruments.

The current monetary system is not only a form of social or economic injustice; it also contravenes US law. The Sherman Act (1890) provides that "Every contract, combination in the form of trust or otherwise, ... in restraint of trade or commerce . . .with foreign nations, is declared to be illegal. . ." The floating exchange rate system is an arrangement that uses the exchange rate to restrict international trade. The so called "oil crisis" is the world wide recession arising from restrain of international trade that followed the introduction of the floating exchange rate system.

It is possible to change the monetary system and to do so without any great drama. The optimum exchange rate system and the guided exchange rate system are examples of monetary systems that can be used to mange bank credit and the exchange rate in such a way that it lowers debt, raises employment and brings prosperity to the economy. These systems are based upon policies that have been applied and proved effective.

Growth of Debt and Loss of Income in America

Home Australia Philippines New Zealand USA

First published: 7 June 2010

Last update: 7 March 2017