Buoyant Economies

The Free Market Monetary Crisis

by Leigh Harkness

My understanding of the monetary crisis in the USA and Europe has been influenced by my experience as an economist in the Treasury of the tiny Kingdom of Tonga.

Up until 1974, Tonga did not have a bank. But it had its own currency. When people brought money into Tonga, the government would convert it into local currency. When people spent their money on imports, the government converted their money back into foreign exchange. In that way, the country always had plenty of foreign currency to pay for its imports.

When Tonga established a bank, the bank started lending money. The money from bank lending did not add to foreign reserves. Yet that money depleted foreign reserves when it was spent on imports. To ensure that the country had foreign exchange to pay for imports, the Treasury had to advise the bank to regulate itís lending according to the level of foreign reserves. If foreign reserves were plentiful, it could lend freely. If reserves were low, the bank had to restrict lending. This proved very successful and even today the country has more than the equivalent of six months imports in foreign reserves. This is despite Chinaís low exchange rate policy.

In America in the early 1970ís, President Richard Nixon appointed Arthur Burns to chair the Federal Reserve with instructions to liberalise bank lending so that the additional money would trick people into believing that the economy was prospering and re-elect President Nixon. As in Tonga, the growth in bank lending depleted foreign reserves. This lending was so damaging to the US foreign reserves that in 1971, the Federal Reserve stopped offering to convert US dollars into gold. By 1973, the growth of bank lending had seriously depleted foreign reserves and was threatening the value of the US dollar. Rather than constrain the growth of bank lending, the re-elected President Nixon blamed speculators for the crisis, and floated the dollar.

Floating the dollar was like using morphine to treat cancer: it treated the symptoms, not the cause of the problem. It treated the falling foreign reserves, not the growth of bank credit. Floating the dollar meant that the US Federal Reserve did not have to convert the US dollars spent on imports into foreign exchange. Instead, people who wanted to buy foreign currency had to exchange their US dollars with people with foreign exchange who wanted US dollars.

The economic policy spin put on this was that it was a major economic reform, allowing the economy to conduct independent monetary policy. The reality was that it provided a framework for legalizing forgery on a grand scale.

Floating dollar protected the US foreign reserves and made the Federal Reserve feel better about the growth of bank credit. Given that money could no longer be earned legitimately from export growth, the government now needed the banks to increase their lending to stimulate the economy. As a result, bank lending was deregulated and banks became extremely profitable. However, the cancerous effect of excessive bank lending continued, causing the US economy to spend more than it earned and accumulate huge foreign debts.

Under the floating exchange rate system, when exports increase, the exchange rate rises to make imports cheaper so that the economy shifts its expenditure from domestic products to imports. This shift in demand destroys import competing industries. As a result, large parts of the US which were highly industrious have wasted away and are now called the rust belt. These victims of injustice were demonized as being inefficient and unproductive.

In Australia, the introduction of the floating exchange rate system has meant that the country no longer prospers from its resources boom. The increased export revenues have only inflated the exchange rate, making imports cheaper than domestic products. The consequential shift in demand from domestic products to the cheaper imports has eradicated many domestic manufacturing industries. Also, the non-booming exporters, such as farmers, have suffered from the inflated exchange rate because they receive lower prices for their exports.

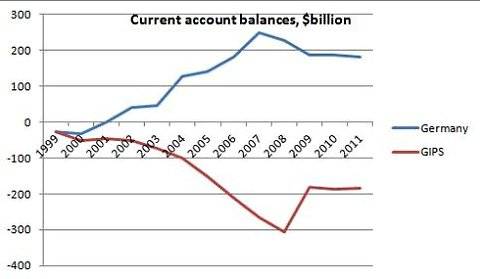

Among the Euro countries, the floating exchange rate system has resulted in even more serious problems because the effects are international rather than regional. The booming export sectors in the Euro zone are in Germany and, to some extent, France. The expanding exports in these countries have inflated the value of the Euro. Cheaper imports from the rest of the world have been forced onto the European market and the European industries that have lost out are in Greece, Italy, Portugal and Spain. This is evident in the following graph presented by Paul Krugman in the New York Times.

The growth of exports in Germany has allowed its economy to prosper with high current account surpluses. If Germany had its own currency and used the floating exchange rate system, the exchange rate system would have ensured that it could not have prospered from the growth of its exports. On the other hand, Greece, Italy, Portugal and Spain have suffered an inverse flow of funds out or their economies as a consequence of sharing the inflated Euro with Germany. What is more, we have recently seen how the countries that have prospered from the Euro are blaming those that have been the victims of the inflated Euro for their own demise, and requiring them to suffer even more.

While these problems can be rectified with a simple fixed exchange rate system or a more sophisticated market exchange rate system, it does require the return to some form of bank regulation. But banks have become like drug addicts. They are addicted to their unregulated power to create debt, which is destroying them, and those that depend upon them. Their power in the current economic order means that we are unlikely to see a quick resolution of these problems.

Home Other issues The Growth of Debt and Loss of Income in America

Impact of the floating exchange rate system on economic growth, wages, employment and trade.

An introduction to the optimum exchange rate system

USA Australia New Zealand Philippines

Last update: 16 November 2011