Buoyant Economies

New Zealand

M3 money supply, current account deficit and inflation

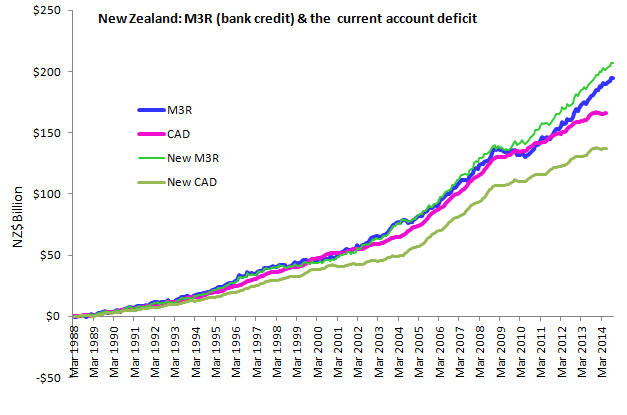

The Reserve Bank of New Zealand has a definition of money that comes from the growth of bank credit and currency. It is called the M3R money supply. It excludes money from foreign sources. The relationship between the growth in the M3R money supply and the current account deficit is shown in the following graph. The M3R data series has been revised since October 2010. Also, the current account deficit statistics have been revised since June 2013 to show as significantly lower deficit. The M3R data shown is the old M3R data to September 2010 and the new data after that date. The old and new current account deficit figures are presented here. The current account deficit after June 2013 is based on the new series data.

As found in Australia, the exchange rate, savings policies, wages policies, training programs etc have no effect at all on this basic relationship between bank credit and the current account deficit. A diagrammatic explanation of this relationship is provided in the Impact of the Floating Exchange Rate System on Debt page at paragraph 32. The sustainability of the debt is considered in Money and Unsustainable Debt. For an additional explanations see the Formula for the Current Account Balance and Technicalities of the Monetary System and to understand the history and broad implications, see the Impact of the Floating Exchange Rate System on Growth and Employment. The Reserve Bank of New Zealand now considers the growth of foreign debt to be a major problem for New Zealand. The Governor states that "the sheer size of servicing our obligations could become an intolerable burden to the country."

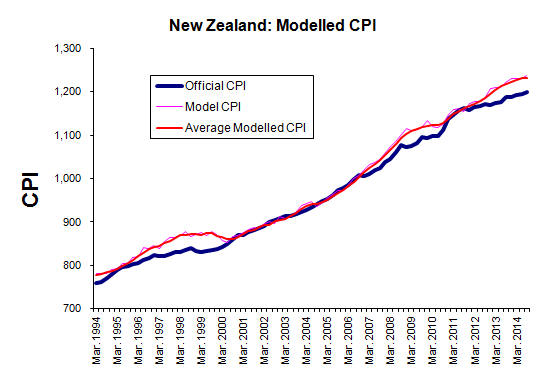

New Zealand: Inflation and the M3R Money Supply

A model was prepared for New Zealand applying the same formula used for inflation in Australia. It is not clear whether the M3R money supply is comparable to the unendowed money supply used in the Australian example. However, as shown in the following chart, the model suggest that they are similar.

The model used to prepare the above graphs is available here.

The derivation of the formula used to calculate the inflation and applied to derive the modelled indices is presented on the Money and Inflation webpage. There are other papers on this and related subjects.

Note that the Reserve Bank of New Zealand states that:

Even so, the Bank continues to use interest rates in an apparent attempt to regulate the growth of the money supply so as to manage inflation.

Home Australia Philippines USA

Last update: 6 December 2014