Buoyant Economies

Philippines

Commercial bank credit and the current account deficit

While passing through the Philippines in July 1994, Leigh Harkness approached the Reserve Bank of the Philippines to obtain the data shown in Figure 1.

Figure 1

Similar relationships have been found for Australia, the USA, New Zealand and India. This relationship is explained on the "Impact of the Floating Exchange Rate System on Debt" page, from paragraph 32. The theory behind this relationship is explained in "Formula for the Current Account Balance".

The Philippines has used the floating exchange rate system for many years. As a result, it was not one of the Asian Tigers that prospered under fixed exchange rates. When these tiger economies moved to the floating exchange rate system, their economies collapsed in what is was called the Asian Crisis. (The West also had a crisis when these countries floated their exchange rates but it was called the "Oil Crisis".)

In recent years, the Philippines has moved away from a strict application of the floating exchange rate system. See the Central Bank's own description of the policy. Philippine banks are allowed to purchase foreign currency for their own accounts, following the Central Bank's guidelines. These guidelines require depository banks to maintain 100% cover for their foreign currency liabilities (except for US dollar denominated repurchase agreements with the Central Bank- Section 73). Also, the Central Bank admits that it intervenes in the market to stabilize the currency and ensure the competitiveness of Philippine products.

The Philippines now builds up official foreign reserves and since 2003 has had current account surpluses. Its foreign investments have increased from the equivalent of 2.6 months imports in 1995 to the equivalent of 12 months imports in 2012. It appears to be stabilizing the exchange rate and raising its foreign reserves. This movement away from the strict application of Friedman's floating exchange rate system is injecting new money into the Philippine economy, thereby stimulating economic growth which was 7.5% in real terms in 2013. At the same time, it is improving the external balance of payments position of its economy.

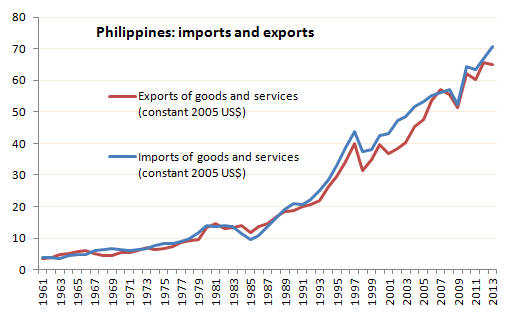

Also, it is contributing to the economic growth of the Philippines. Figure 2 shows the growth imports and exports in the Philippines. The global financial crisis had reduced exports in 2008 and 2009 and reduced imports in 2009.

Figure 2: Exports and Imports in US$ (constant 2005 Billion)

(source World Bank)

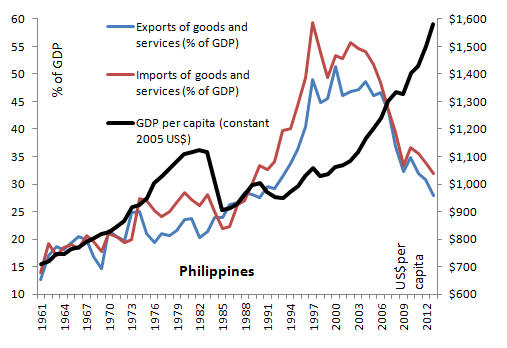

Despite the general rise in the amount of imports and exports over these years, imports and exports as a share of Gross Domestic Product, have declined since peaking at 59% in 1997, as shown in Figure 3. The fact that exports and imports are rising but are declining relative to gross national income implies that gross national income is growing faster than imports and exports. This is evident in the 42% growth of GDP per capita in the last 10 years.

Figure 3: Exports and Imports as a percentage of GDP (source World Bank)

Even so, further reform to monetary policy of the Philippines could see that economy grow more rapidly to utilize the existing high level of unemployed resources while maintaining balance of payments stability. An explanation of the conditions for balance of payments stability is provided on the Formula for Current Account Balance.

To read more about this, see the papers on the subject.

Return Australia New Zealand USA

Last update: 06 December 2014