Buoyant Economies

Fiscal policy guiding monetary policy to economic growth

A December 2014 article in the official Russian newspaper, Pravda, revealed that the Russian government was surprised to find that “the Central Bank of the Russian Federation does not have to support the Russian economy.”[1]

Many countries have legislation that requires their central banks to support their economies. But very few central banks actually support their economies. Such central banks often see their role as being limited to reaching targets for inflation and ensuring that banks are sufficiently profitable to ensure that banks remain viable. Bank viability is necessary to inspire confidence in them so that the money held in them in the form of bank deposits (bank liabilities) is readily accepted when transferred.

In many cases, central banks regard any action to support their economies as undermining a self appointed international obligation for free trade. But supporting ones own country does not undermine free trade: rather, it is essential that central banks support their economies so that domestic and international trade is sustainable. The Central Bank of the Philippines acts to support the domestic economy through two policies:

· Stabilising the exchange rate; and

· Restricting the growth of bank credit by limiting the ratio of a mortgage to the value of the property.

Stabilising the exchange rate

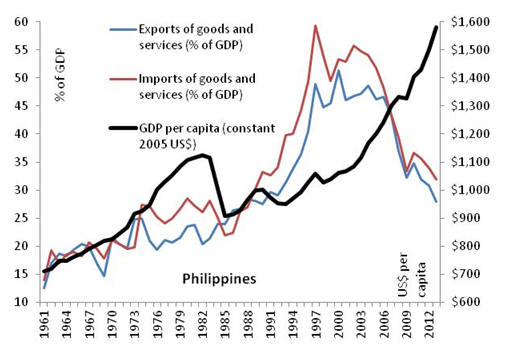

Before the Central Bank of the Philippines intervened to stabilise the exchange rate, spending on imports as a proportion of GDP in the Philippines was rising rapidly. That is, rising foreign income inflated the exchange rate, people were shifting their spending from domestic products to the cheaper imports. Spending on imports reached 57% of GDP in 1997. Also, the Philippines had current account deficits which were raising its foreign debt: an unsustainable position.

The policy of stabilising the exchange rate shifted domestic spending back to domestic products. The initial policy was too aggressive and had to be relaxed. But a more sustainable policy was applied in about 2003 that allowed the Philippine economy to reduce the proportion of GDP spent on imports and it reached 32% it 2013 as shown below.

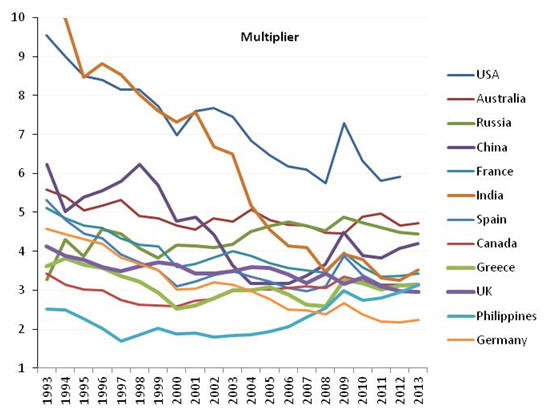

The Multiplier

The proportion of GDP spent on imports is a very powerful factor in the economy. The inverse of the marginal propensity to import[2] is known as the trade multiplier. The trade multiplier is the effect on national income of an additional dollar of export income. Thus if a country spends 50% of its GDP on imports, its multiplier would be 2 and an additional dollar of export income would raise national income by two dollars. If a country spends 33% of its GDP on imports, its multiplier would be 3 and each additional dollar of export income would raise national income by $3. If exports had remained the same when the Philippines reduced its marginal propensity to import from 57% to 32%, it would have increased its national income earned in the formal monetary market by about 80%.

As shown below, exports from the Philippines have increased 62% in terms of constant (2005) US dollars since 1997, providing an ever greater stimulus to the Philippine economy. According to the World Bank, GDP in the Philippines, in terms of constant US dollars has grown 102% between 1997 and 2013. The effect on per capita incomes is shown in the chart above. The growth of exports and the increase in the multiplier indicate that the monetary side of the economy would have grown about 200% over that period. [3]

It is clearly evident from the chart above is that the Central Bank of the Philippines’ intervention in the exchange rate has not reduced imports. Imports have increased 61% over the same period. Therefore, the evidence indicates that any objection to central bank intervention in the exchange rate on the basis that it reduces international trade is not valid.

When we compare the multiplier for a number of countries, there are a variety of outcomes. Of the sample selected, Russia and the Philippines are the only economies to have improved their multipliers over the last 20 years (by 26% and 20% respectively). Over the last 10 years, the multipliers for the Philippines and China have improved by more than 10%. The multipliers have varied by less than 10% for Russia, Greece, Canada and Australia. The multiplier has declined by more than 10% in India, Germany, USA, UK, France and Spain.

Economies with growing exports and rising multipliers grow more rapidly (e.g., China and the Philippines) compared to those with stable or declining multipliers (other things being equal). Other economies can grow, but if the multiplier were declining, the rate of economic growth would be lower than the rate of growth of exports. The monetary economy of India could have been about 194% larger than it is now if the multiplier had remained at its 1993 level. For Germany, the monetary economy could have been 104% higher, Spain 69%, USA 61% and France 49%.

The main determinant of the marginal propensity to import, and thereby the multiplier, is the exchange rate. Consequently, the exchange rate and the exchange rate system can have substantial consequences for the rate of growth and the income levels in an economy.

If the exchange rate is being used to achieve objectives other than economic growth, the cost to the economy, and the welfare of its people, can be substantial.

Yet most western economies use their exchange rate system to attain monetary independence. Monetary independence is a rather useless objective. It profits no-one other than the banking system. It means that the only source of monetary growth is bank credit. It makes bank lending (and rising levels of debt) necessary for economic growth and makes banks very profitable institutions in the economy. Also, the floating exchange rate system (used to support deregulation of bank lending) means that when banks lend, the increased imports do not affect foreign reserves.

The growth of foreign debt

In an economy without a banking system, the government would convert foreign currency earned from exports etc, into domestic currency. The government would hold the foreign currency as foreign reserves. When that domestic currency was spent on imports, the government would draw on its foreign reserves to convert the domestic currency back into foreign currency to pay for those imports.

In an economy with a banking system, the banks would convert foreign currency earned from exports etc, into domestic currency. The banking system would hold the foreign currency as foreign reserves. When that domestic currency was spent on imports, the banking system would draw on its foreign reserves to convert the domestic currency back into foreign currency to pay for those imports.

However, banks also lend money and that money generates imports. To pay for those imports, the banks would draw on their foreign reserves. However, if they draw on their foreign reserves to pay for imports generated by money from bank credit, they are unlikely to have adequate foreign reserves to pay for the imports generated by the money from exports. To avoid depleting foreign reserves, the banking system has had to regulate its lending.

When bank lending was deregulated, banks increased their lending and that additional money raised imports and depleted foreign reserves. Floating the currency was seen as a means of protecting bank foreign reserves by ensuring international receipts and payments were equal. As international currency flows no longer affected the domestic money supply, the floating exchange rate system was seen as a mechanism for attaining “monetary independence”. Milton Friedman promoted monetary targeting as a means of avoiding economic cycles. Friedman considered that monetary independence was necessary to enable monetary targeting. However, monetary targeting has long been abandoned yet Friedman’s legacy has remained in the form of the floating exchange rate system.

The floating exchange rate system also ensures that bank lending no longer affected foreign reserves. In fact, the system ensures that any form of international transaction does not affected foreign reserves, including any growth in trade or international capital flows.

Bank lending continues to cause the economy to buy more than it has produced and generates current account deficits. But the banks are e no longer responsible for converting domestic currency into foreign exchange and for preserving the exchange rate. Nor do they need to find the foreign funds to pay for the imports. That is all taken care of in foreign exchange market and the international finance market.

While countries experienced “monetary independence”, they have become capital dependant on other economies to finance the excessive levels of imports generated by bank credit. Thus bank credit not only raises domestic debt, it raises foreign debt.

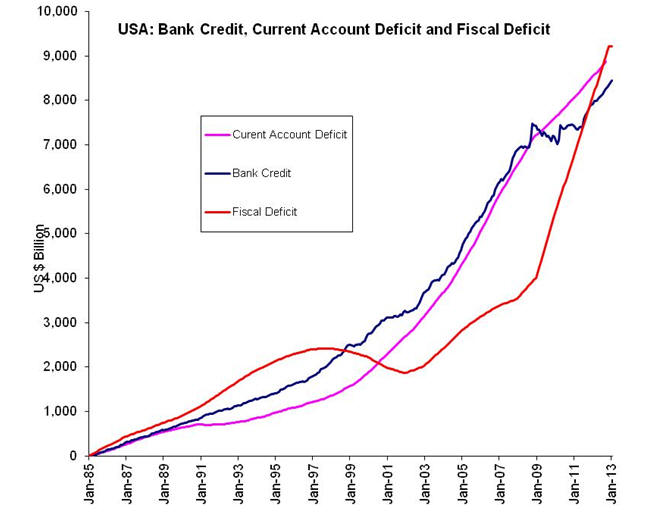

The following chart compares the current account deficit of the USA with the growth of bank credit and the fiscal deficit. It reveals that the current account deficit grows with the growth of bank credit. If the current account deficit were related to the fiscal deficit, it would have declined between 1998 and 2001 when the USA experienced fiscal surpluses. But it did not. There is even stronger evidence from other economies showing that the current account deficit is directly linked to the growth of bank credit.[4]

It should be noted that since 2003, following the modification of its exchange rate and lending policy, the Philippines has experienced current account surpluses. The restriction on the level of bank lending for mortgages reduced the rate of growth of bank credit to below the growth in money being generated from international trade that would have occurred if there were no bank lending. That has meant that foreign reserves have been more than adequate to meet the additional demand for imports from the growth of bank credit, allowing foreign reserves to rise. Consequently, Philippine foreign reserves relative to debt have increased from 17% of foreign debt in 1997 to 136% of foreign debt in 2012.

Since the deregulation of bank lending in western economies, banks have achieved the capability that alchemists have dreamed of for centuries: to ability to create gold. In the case of banks, it is the ability to create unlimited amounts of money. This power is something that banks all over the world seek to preserve, at any cost. Banks are prepared to sacrifice the prosperity of their own country’s economies to preserve the precious power of their bank to create money.

Yet bank lending causes considerable damage to an economy. It causes the country to buy more than it has produced and thereby raise foreign debt. Bank lending can cause the exchange rate to depreciate. For example, if Russia to raise its exchange rate again, it must restrict the growth of bank lending and take advantage of the low exchange rate to raise exports and do so in a manner that injects additional money into the economy. Money from income such as exports is more stabilising for an economy than money from bank debt, which raises both domestic and foreign debt. Rising debt levels causes instability in an economy. If incomes fall so that borrowers cannot repay their debt, the whole financial system can collapse, as happened in the USA, UK and Europe in 2008.

The greatest threat to the banks powers would be if a major economy were to adopt a more regulated banking system that enabled its economy to prosper, leaving other economies behind. China has been able to prosper because of its exchange rate mechanism. The US has been lobbying it to change that system. However, the Chinese economy has become the main source of economic growth in the world, so that the pressure on China to change its exchange rate system has waned of late.

China has an American style banking system that is rapidly raising domestic debt. This does threaten the stability of the Chinese financial system. However, for the moment it suits the banks for China to prosper because it provides proof that an economy can prosper under a deregulated banking system.

Although the Philippines has different monetary outcomes to western economies with floating exchange rate systems, it declares that its system to be similar to the system in the US. Therefore, it is not seen as a threat to bank deregulation and there has not been significant pressure on it to change its policies.

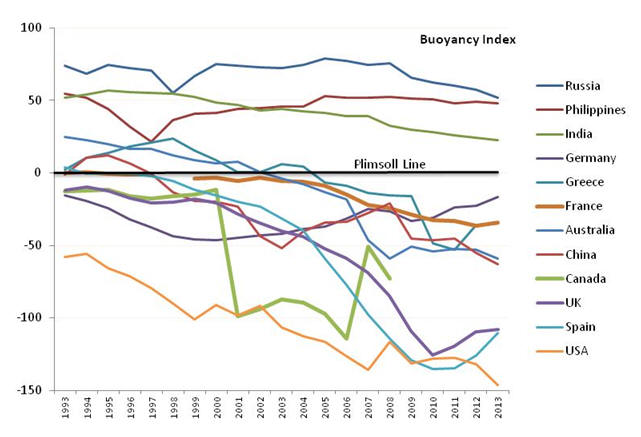

The following chart entitled the “Buoyancy Index” compares the domestic debt levels of a number of economies. The Buoyancy index is determined by subtracting the domestic credit provided by the financial sector as a percentage of GDP recorded in World Bank statistics from 100. Countries below the “Plimsoll line” with a negative index have a greater risk of collapsing as a result of an economic shock.

This chart shows Russia to have the most resilient economy with low levels of domestic credit from its financial sector and best able to withstand any destabilising factors and thereby avoid an economic or financial crisis. The USA is shown to have the lowest level of resilience. Its economy and financial system have already been through an economic and financial crisis. Even so, its domestic debt from the financial sector is continuing to rise at a faster rate than its GDP, making it increasingly susceptible to destabilising factors.

The deteriorating situation in the USA is allowed to proceed because US banks control the US central bank, the Federal Reserve. The Federal Reserve is intent on raising the level of domestic lending to raise the profits of its member banks. It justifies the growth in lending as being necessary to raise economic growth. The Fed is clearly acting only in the short sighted interests of US banks. These banks have a high and increasing rising risk of collapsing completely, together with the whole economy, in response to a shock to the economy that may reduce incomes, and the ability of borrowers to service their debt.

The Russian government should not be surprised that the Central Bank of the Russian Federation (which was modelled on Western systems) does not have to support the Russian Economy. Not even the US Federal Reserve has to support the US economy, and it does not.

An alternative approach

Although central banks may not be required to support the domestic economy, governments can put in place instruments to encourage individual banks to support the economy. For example, banks could be given incentives, such as tax exemptions, if they support the domestic economy to attain economic growth, full employment, financial stability and price stability.

One approach would be to apply a Tobin tax on all bank deposits. That tax may be just 0.5% of any funds that are deposited in a bank. Customers could withdraw funds without charge. They would be subject to the charge only when the funds were deposited in a bank. The banks that adopt government's monetary policies that support economic growth and financial stability would be exempt from the tax.

Such an approach would enable banks that did not wish to adopt the government’s polices to continue to function. However, those that did adopt the policy would be more attractive to customers and likely to be more profitable.

The government’s policy could take the form of the optimum exchange rate system, requiring that:

1. Banks could increase their total level of lending by up to, say, $10 of domestic currency for every US dollar (pound or Euro) increase in their net foreign assets (foreign assets less foreign liabilities); and

2. For every 1% that inflation exceeds, say, 2% or unemployment exceeds, say, 3%, the amounts that participating banks could lend for every US dollar (pound or Euro) increase in their net foreign assets would be reduced by $1 .

Thus, if unemployment were 5% and inflation 6%, banks could lend $4 for every US dollar (pound or Euro) increase in their net foreign assets.

The first guideline means that banks would be buying foreign currency and converting it into domestic currency. That would stimulate the domestic economy with more income and money without raising debt. Also, the foreign reserves accumulated by these banks would be savings of the economy. This guideline ensures that banks can lend, only as national savings increase.

The second part of the guidelines provides direction to the exchange rate. The banks would drive the exchange rate to a level that would attain the government’s employment target (unemployment of less than 3%) and its target for price stability (inflation of less than 2%).

If the exchange rate were to rise higher than these levels, the participating banks would buy up foreign exchange, injecting money into the economy and stimulate it. Also, those increased foreign reserves would enable them to increasing their lending, providing further stimulus to the economy and increasing the supply of domestic currency on the foreign exchange market, thereby assisting efforts to hold down the exchange rate.

If the domestic exchange rate were lower than the required level, then participating banks would be reluctant to buy the expensive foreign exchange and make a future loss. The lack of foreign exchange would constrain these banks from lending. That would reduce the supply of domestic currency on the foreign exchange market and put pressure on that market to raise the exchange rate towards the optimum level.

Banks would implement these policies to attain the tax advantage. Hence, tax offices could administer these type of guidelines.

Central banks around the world are implementing policies that are undermining their economies. In some case, they are unaware of the effect of their policies. In other cases, they are well aware, and are modifying their statistical reports to hide the effects of their policies.

The main organisation promoting these unsustainable monetary policies is the IMF. The IMF was established to bring about stable exchange rates to facilitate stable and sustainable international trade and to use the US dollar as the main currency in which countries were to hold their international reserves.

The IMF is now opposed to the objectives for which it was originally formed. It now fosters exchange rate instability, encouraging economies to isolate their money supply, and thereby their economies, from the stimulus that can be attained from international trade. It now supports the growth of bank credit as the source of monetary growth and market determined exchange rates. There is no problem with having the market determine the exchange rate. But if the rules of the market constrain real trade, those markets can damage the economy. Also, if the markets are established to protect destabilising financial practices, such as printing money, they need to removed together with the practices that they have been hiding.

Bank credit undermines the monetary system. Reciprocity is the basis of trade. That is, when someone sells products, the money they earn entitles them to buy products of equivalent value. In this way, entities within the economy exchange goods amongst each other and there are sufficient products for all participants. Bank credit entitles the borrower to demand products without there being a reciprocal supply of products. The borrower may supply products in the future, but in the current time and until the loan is repaid, there is a deficit (a current account deficit). Even when borrowers repay their debts it does not resolve the problem because banks have lent even more money, so that the economy continues to buy more products than it has produced.

Furthermore, bank credit raises debt and the economy needs money to service those debts. Thus only part of the additional money that the banks create is being spent on products and thereby used to generate income. That means that debt in the economy is growing faster than production. Another way of saying this is that debt is growing faster than the capacity of the economy to repay its debt. Eventually the debt will exceed the capacity of the economy to repay debt, and the economy will collapse, as in the USA financial crisis, European financial crisis and the UK financial crisis.

“The Central Bank of the Russian Federation does not have to support the Russian economy.” Neither are the central banks of many other countries obliged to support their economies. Without clear direction, commercial banks will capture their central bank regulators. Once captured, governments would not be able to rely on central banks to support the economies of their own countries. In such cases, central banks are likely to behave like the leaders of a mafia gangs, acting in the interests of their banking family rather than in the interests of the whole economy.

[2] The marginal propensity to import is the proportion of each additional dollar entering an economy that is spent on imports.

[3] GDP includes estimates of production that are not affected by monetary factors. For example, the production of subsistence farmers and the rent of owner occupied dwellings. If the non monetary side of the economy were about 50% of the economy, a 200% increase in the monetary side of the economy would raise total GDP by 100%, other things being equal.

Home Philippines New Zealand USA India

Growth of Debt and the Loss of Income in America

Last update: 5 January 2015