Buoyant Economies

Australia - inflation

Australia: Money and Inflation

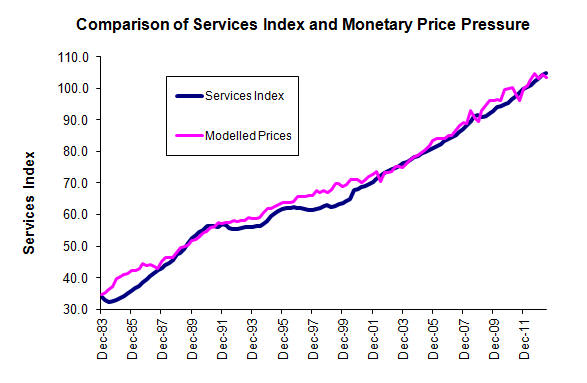

Economists have for many years tried to identify the relationship between money and inflation. There is a clear relationship between money and inflation described in section 3.3 of The failings of monetary policy in Australia that was written in 1995. The relationship described continues to exist as shown in the following chart of the consumer price index (CPI) as calculated by the Australian Bureau of Statistics (ABS) and the monetary price pressure that underlies most inflation.

This strong relationship is shown to exist over 25 years and suggests that other factors such as exchange rates and fiscal policy have little direct effect on inflation. The wages and incomes accord can be seen to have had some effect in the mid to late 1980s. Also, wages policy appears to have had some effect in the mid to late 1990s. Fiscal policy has an effect only insofar as it affects the unendowed money supply (the government borrows from the banking system).

There appears to be a lag of around 6 months to a year between the official CPI and the monetary price pressure (the model is not lagged). That is, the growth in the unendowed money supply occurs first and its effect on prices follows rise three to nine months months later.

One of the features of the unendowed measure of money is that it excludes money created from the purchase of foreign reserves. Such money is endowed and does not cause inflation.

When the Reserve Bank sells foreign reserves, it has the opposite effect on inflation. It reduces the amount of endowed money. This does not cause inflation as it has not increased the amount of unendowed money. However, if it is done as an attempt to reduce the growth of the money supply to reduce inflation, it will be ineffective. Even if there were no increase in the total amount of money following the sale of foreign reserves, the reduction in the amount of endowed money and the increase in the amount of unendowed money means that the outcome is inflationary.

The growth of bank credit in Australia has little influence on the price of imported goods. Imported goods make up a large part of the goods included in the inflationary index for goods. When we apply the same approach as for the CPI to the goods index, it is evident from the following chart that the growth of bank credit is not explaining the price movements. This is particularly evident since about 2001.

On the other hand, the growth of bank credit is more likely to explain changes in the price of domestic products such as services. This is clearly evident in the following chart which compares the ABS Services Price Index to the price pressure from monetary sources.

The growth of bank credit is more likely to explain food prices as these have a significant domestic content. The following chart models the food price index using the same approach. While the growth of bank credit does not explain all the price variations, it reveals a very strong relationship.

A comparison of the underlying monetary inflationary pressures and the housing index reveals the speculative booms and busts associated with the housing industry. In this case, the base quarter for the modelled index is December 1996.

To view the Excel model used to calculate these relationships together with the sources of data (data series since April 2002) use this link and go to the Inflation worksheet.

Note that the Reserve Bank of Australia (RBA) state that "We haven't found monetary models to be particularly informative for inflation over our forecast horizon." Hence readers should be wary about putting significant weight on the above relationship. However, the RBA's admission appears to inconsistent with its own actions. The Bank has been raising interest rates in an attempt to reduce monetary growth and so reduce the rate of inflation yet it states that it has found no useful relationship between monetary growth and inflation.

The optimising exchange rate provides monetary growth from foreign reserves as well as from bank credit. Money from the growth of foreign reserves is endowed money and it does not have the same inflationary effect as money from bank credit. Hence, we could expect lower levels of inflation if such an open variable exchange rate system were adopted.

It is possible for the government and the Reserve Bank to directly raise the amount of endowed money to stimulate the economy without causing inflation and current account deficits. They could also reduce the level of unendowed money to reduce the current account deficit and lower the rate of inflation.

Most economic literature assumes that there is a proportional relationship between the money supply and prices. That is, a 10 per cent increase in the money supply will cause a 10 per cent increase in prices, other things being equal. But that is not the case. As stated above, the evidence reveals that the change in the prices is equal to the square root of the change in the unendowed money supply over the change in the real gross domestic product.

The reason for this relationship is related to the fact that money is not only a record of endowments, it is also a record of outstanding loans, and obligations to supply goods in exchange for debt. The explanation based on this rational is explained on the Money and Inflation webpage.

To read more about similar issues, look up the papers on the subject and the submission to the Financial System Inquiry.

Return Philippines New Zealand USA

Last update: 8 August 2013