Buoyant Economies

Impact of the Floating Exchange Rate System on Debt

Formula for the Current Account Deficit

Impact of the floating exchange rate system on employment and growth

Growth of Bank Credit and Loss of Income in America

"I believe that banking institutions are more dangerous than standing armies... if the American people ever allow private banks to control the issue of currency... the banks and corporations that will grow up around them will deprave the people of their prosperity until their children wake up homeless on the continent their fathers conquered." Thomas Jefferson

The floating exchange rate system

- To understand the international currency exchange system and its impact on our economy's prosperity it is useful to look at how money works and its connection with international trade. We often hear that the value of our currency has increased or decreased against other currencies. Or, we might read that importers are pleased or exporters are not pleased with the latest current exchange rate, or vice versa. This fluctuation in value occurs because many countries have adopted what is known as a Floating Exchange Rate System.

Money Basics*

- Money is intended to distribute what is produced amongst those who have produced it. The money people earn from selling their produce enables them to buy goods and services and also constrains them to buy no more than the value of what they have produced and sold.

- When one person lends money to another, the lender reduces their ability to spend to allow the borrower to spend that money. Such lending does not cause total spending to increase above production: the lender is forgoing spending to allow the borrower to spend.

- If we work for someone, the money our employer earns enables them to pay us and buy goods up to the value they have produced. The wages, or money we are paid, enables us to buy some of the goods to which our employer would otherwise have been entitled.

- If the government taxes people and spends only that money, the government ensures that it is not buying more than people would otherwise have spent or been entitled to spend. Even if the government borrows from people to increase its spending, the lenders are voluntarily reducing their spending to allow the government to increase its spending. If everyone in a country spends only the money they have earned or borrowed from someone else who has earned it, then the country will not buy more than it produces.

Increased spending and national savings

- In the Bretton Woods era, before 1973, the fixed exchange rate system was the norm among western economies. If a country with fixed exchange rates exported more than it imported, its foreign reserves would increase. Exports are part of a nation's income and imports are part of its expenditure. If a nation exported more than it imported, it meant that it was earning more income from the rest of the world than it was spending in the rest of the world. Therefore, the nation was said to be saving.

- Also, as the money earned and injected into the country from exports is greater than the money that leaks out on imports, the amount of money in the country is increased. That additional money enabled people to spend more in the country and that spending enables its economy to prosper. It increases spending (demand), resulting in increased production which creates jobs and raises wages.

Increased spending and national debt

- When a person with a debt to a bank repays the principal of that loan, they are reducing their spending below what they have earned. When a bank lends that money, it enables a borrower to spend more money than they have earned. If new bank lending is equal to loan repayments, then the increase in spending financed by the bank loan is equal to the reduction in spending caused by repayment of the loan.

- If banks lends more than has been repaid to them, then they would be increasing the amount of money in the economy and they would be financing spending greater than what has been earned or produced in the economy.

- When people within a country spend money buying products from other people in that country, the income of the country from domestic spending is equal to that spending. The only way a country can spend more than it has earned (or produced) is to import more than it exports. To pay for those imports, a country needs foreign currency. If it has foreign currency in reserve, it can use its foreign currency reserves to pay for the goods. If it has gold reserves, it may pay for those goods with gold. Alternatively, it can borrow foreign currency and increase its foreign debt.

Floating exchange rate - the Nixon legacy

- Bank credit was growing rapidly in the US during the mid 1960's and early 1970's as shown in Figure 1. This contributed significantly to the growth of additional money in American and caused the US economy to buy more than it produced. As a consequence, the US experience current account deficits in 1969 and again in 1971 and 1972. At that time, the US offered to convert US dollars into gold at a rate that was significantly lower than the market price of gold. Given that imports exceeded exports and other foreign income, some countries chose to be paid in gold for the difference. Consequently, US gold reserves were severely depleted.

- The Federal Reserve was, and continues to be, responsible for American monetary policy and the nation's foreign reserves. Yet many of the members of the twelve boards of each district of the Federal Reserve were, and continue to be, former bankers.

- At the same time President Nixon was seeking re-election in 1972. After tightening monetary policy in 1969-70, he allowed loose monetary policy to stimulate the economy in 1971 and 1972 and did not raise taxes to pay for the Vietnam war. He imposed price controls, devalued the currency and declared that the US would no longer convert US dollars to gold. He presented this in such a way that he was rescuing the US economy from price gougers and foreign speculators.

- In March 1973, Richard Nixon adopted a foreign reserve retention scheme commonly called the "floating exchange rate system". This policy suited the Federal Reserve because it preserved foreign reserve and did not require them to restrict the growth of bank credit.

Figure 1: USA - Rate of growth of bank credit to March 1973

Floating exchange rate - implications

-

Under the floating exchange rate system, the exchange rate fluctuates or "floats" to ensure that foreign receipts equal foreign payments so that the foreign reserves of the US Federal Reserve are no longer drawn upon, or added to. That is, money entering the USA was required, and continues to be required, to equal the amount of money leaving the country.

- Exporters still convert their foreign earnings to local currency at a bank and importers still go to the bank to buy foreign currency to pay for their imports. However, the banks are no longer allowed to add the excess foreign earnings into foreign reserves not to pay for imports and other foreign expenses from foreign reserves reserve.

- Instead, banks were required to trade their foreign currency earnings from exports and other sources with those other banks and financial institutions wanting to buy foreign currency (with domestic currency) to pay for their imports and other foreign expenses. Thus spending on imports and other foreign payments is required to equal to earnings from exports and other sources of foreign currency.

- We have already acknowledged in paragraphs 8, 9 and 10 above that if bank lending causes national spending to be greater than national income, then imports have to be greater than exports. This is described in more detail in the impact of the floating exchange rate system on employment and growth.

Current and capital transactions

- The foreign exchange market consists not only of current transactions to pay for imports and exports; it includes capital transactions such as international investment and international loans. A country that is financially secure and has high interest rates is likely to attract more international investment than it invests internationally. Also, a country whose exchange rate appears low may be attractive to investors wanting to speculate on an appreciation of that currency. Furthermore, borrowers may choose to borrow from a country with lower interest rates and investors may choose to invest in countries with higher interest rates. These capital transactions are part of the foreign exchange market.

- International payments and receipts are required to be equal in the foreign exchange market. Hence, a surplus of foreign investments and loan receipts can offset a deficit on the current account (trade and other income transfers).

- So, while floating the dollar preserves official gold and foreign reserves, it does not prevent the country from increasing foreign debt (or selling capital assets) to pay for any imports in excess of exports. That is, while the floating exchange rate system may preserve the banking system's foreign assets and gold reserves, it does not protect the nation's assets nor prevent it going into debt.

Floating exchange rate - eliminates national savings

- Floating the dollar has another side effect. Under the fixed exchange rate system, an increase in exports causes additional money to flow into the economy. As we saw in paragraph 6, it is a form of national saving that enables the country to increase its spending. But under the floating exchange rate system, there is no national saving: no increase in foreign reserves. An increase in export income requires an immediate increase in spending on imports.

- For example, if the country increased its export of chemicals, the only way those exporters can convert their funds to local currency is if there is an increase of imports of, say, pots and pans. Those pots and pans are imported to be sold within the economy.

Floating exchange rate - beggars thy brother

- If these pots and pans are to be sold in the domestic market, they must be cheaper than pots and pans made in the local economy. Consequently, the local producers of pots and pans lose business. This requirement for imports to increase when exports increase has unfortunate consequences. Export success in some industries in an economy with a floating exchange rates undermines the competitiveness of other industries in that economy. Those industries forced to compete with imports intentionally made cheaper by the 'float' can be put out of business. The floating exchange rate system requires demand for imports to rise. Without an increase in total demand, it can only mean that demand for domestic products must decline. The Australian government acknowledged the restrictive nature of the exchange rate system. In the Treasurer's 2011 budget speech, he states that "the dollar is around post‑float highs and this makes it difficult for some sectors, particularly those that compete in international markets."

Nixon's recession - the oil crisis

- In an environment of fixed exchange rates, there are two sources of new money: increased foreign reserves and bank credit. Floating the exchange rate eliminates increasing foreign reserves as a source of new money. Hence the only source of new money is the growth of bank credit.

- Richard Nixon had to convince other major traders UK, France, Germany and Japan first to discard the Bretton Woods Agreement if he was to succeed with his policy of floating the US exchange rate to meet his own political agenda. This he did by making his problem their problem. He asked the group of ten countries to revalue their currencies and then when that failed, offering them little alternative but to float their exchange rates.

- When the US floated its exchange rate together with the other countries, there was a sudden reduction in the rate of growth of export income and the amount of new money entering the US economy. Economies need additional money to grow. Nixon's policies meant that there was no longer any growth in the amount of money from trade.

- This reduction in monetary growth combined with a reduction in the growth of bank credit in 1975 and 1976 (see Figure 2). It caused a recession which was called the Oil Crisis to shift the blame for the recession away from President Nixon and blame OPEC. (The release of statistics revealing a recession in the USA coincided with the OPEC decision to raise oil prices.)

Figure 2: USA- Rate of growth of bank credit to April 2010

Post Bretton Woods - Financial deregulation and foreign debt

- A policy of expanding bank credit is likely to have caused the financial crisis of the early 1970's. However, once the exchange rate was floated, banking deregulation was necessary to allow the growth of bank credit to stimulate the economy.

- Financial deregulation was touted as a desirable policy stance and so Australia followed the US in deregulating its financial system. This caused excessive bank lending. It depleted foreign reserves and destabilised Australia's fixed exchange rate system, forcing the Australian government to float the exchange rate in December 1983 to preserve its foreigns.

- Since 1983 Australia's gross external debt, then 22% of its Gross Domestic Product (GDP) has escalated at a steady rate to be more than 100% of GDP, and it is still rising.

Graphic explanation of the relationship between bank credit and the current account deficit

-

The relationship between bank credit and the current account deficit in an environment of floating exchange rates can be explained using the following chart.

Current Account Deficit and Bank Credit

- In this chart, the real exchange rate is on the vertical axis and income, expenditure, exports, imports, international capital flows and credit growth are measured on the horizontal axis. The supply of exports is given by the X-X line, the demand for imports is given by the M-M line and national income by the Y-Y line. If we exclude credit growth and capital flows, the equilibrium exchange rate would be at e1 with exports and imports equal at A1 and national income at Z1. National income is made up of exports (0-A1) and sales of products to the domestic economy (A1-Z1).

-

If we now assume

commercial bank credit of 0-B1, national expenditure (0-Z2) exceeds

national income (0-Z1) by the growth of bank credit. This can be

put:

E = Y + Cr (1)

Where: E is national expenditure;

Y is national income; and

Cr is the growth of commercial bank credit.

-

We can further define income

and expenditure as according to the sources of income and the

direction of expenditure as follows:

Y = N + X (2)

Where: N is the sale of local products in the domestic economy (A2-Z2); and

X is sale of exports (0-A3).

E = N + M (3)

Where: N is the purchase of domestic products (A2-Z2); and

M is the purchase of imports (0-A2).

-

Substituting equations 2

and 3 in equation 4, we can conclude:

N + M = N + X +Cr

M = X + Cr

M – X = Cr (4)

- That is, we have concluded that to clear the domestic goods market, the current account deficit must be equal to the growth of bank credit. This relationship is verified by the data presented elsewhere for the USA, Australia, New Zealand, India and the Philippines. It is explained further using dynamic models in "Formula for current account balance".

-

Also, we know that to clear

the foreign exchange market imports must equal exports plus net

foreign capital inflow. That is:

M = X + K (5)

Where K is the net foreign capital inflow.

-

From equations (4) and (5)

we can conclude that:

M - X = K = Cr (6)

- The equality between the growth of bank credit and net foreign capital inflow is shown in the chart as the K–Cr line. When net foreign capital inflow is added to exports, the supply of foreign currency is given by the X+K – X+K line.

- Equilibrium in the foreign exchange market is now attained at the exchange rate e2. At that exchange rate, imports rise from 0-A1 to 0-A2. Exports decline from 0-A1 to 0-A3. The difference A3-A2 is the current account deficit which is equal to: the net capital inflow (0-B1); the growth of bank credit (0-B1); and the difference between national expenditure and national income (Z1-Z2).

- National income is made up of exports (0-A3) and sales of domestic products (A2-Z2). National expenditure is on imports (0-A2) and the purchase of domestic products (A2-Z2). The difference between national expenditure and national income (Z2-Z1) caused by the credit growth in the domestic market generates imports in excess of exports (A2-A3) that is financed by foreign capital on the foreign exchange market. That is, the growth of bank credit causes the rise in foreign debt and, therefore, a reduction in the nation's wealth. See also the implications of inflation for foreign debt where foreign debt must grow faster than the capacity to repay that debt.

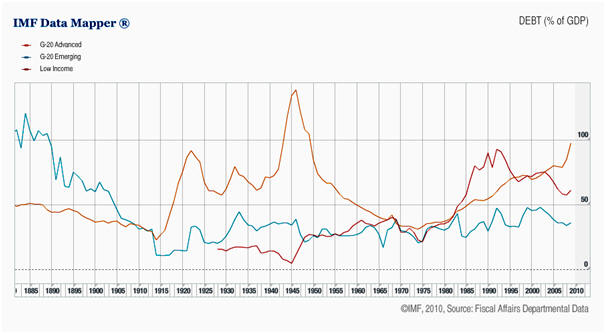

- I am not the first to identify these changes in the economy. The IMF Working Paper WP/10/245 on

A

historical public debt database shows the Debt to GDP ratios

across country groups. As shown below, the turning point where

debt to GDP starts to rise for G20 countries is 1973, the year that

the US floated its exchange rate. For these G20 advanced

countries, floating the exchange rate has raised their debt levels.

-

Page 11 of the paper states that "by 1960 . . . the advanced G-20 economy average debt ratio declined to 50 percent of GDP. . .. Average advanced G-20 economy debt ratios trended down further through the early 1970s; however, debt began to accumulate starting in the mid-1970s, with the end of the Bretton Woods system of exchange rates and two oil price shocks. This upward trend continued until the current global financial crisis."

-

The problem now facing Western economies is that they require monetary growth to stimulate their economies. Yet under the floating exchange rate system, the only source of monetary growth is bank credit. That source raises their domestic debt and their foreign debt. While the additional money from bank credit may stimulate growth in their economies, their bank debts grow at a faster rate. This is unsustainable. Eventually the debt burden will exceed the capacity of the economy to repay its debt. (See: Money and Unsustainable Debt.) That will destroy the monetary system and the banks with it.

-

There are solutions to these problems. See Prosperity for Greece for a short explanation. For a detained analysis, see Saving the Euro.

* This section is to do with the monetary system, the basic operating system of the economy.

A more detailed analysis of the relationship between the bank credit and the current account deficit can be found at Formula for the Current Account Deficit.

A more detailed description of the technicalities of debt

Icelandic Economics - Olafur Margeirsson and the effect of floating the exchange rate on Iceland

Growth of Bank Credit and Loss of Income in America

Impact of the floating exchange rate system on employment and growth.

The guided exchange rate and liquidity system

Last update: 23 May 2017

First posted: 17 January 2010